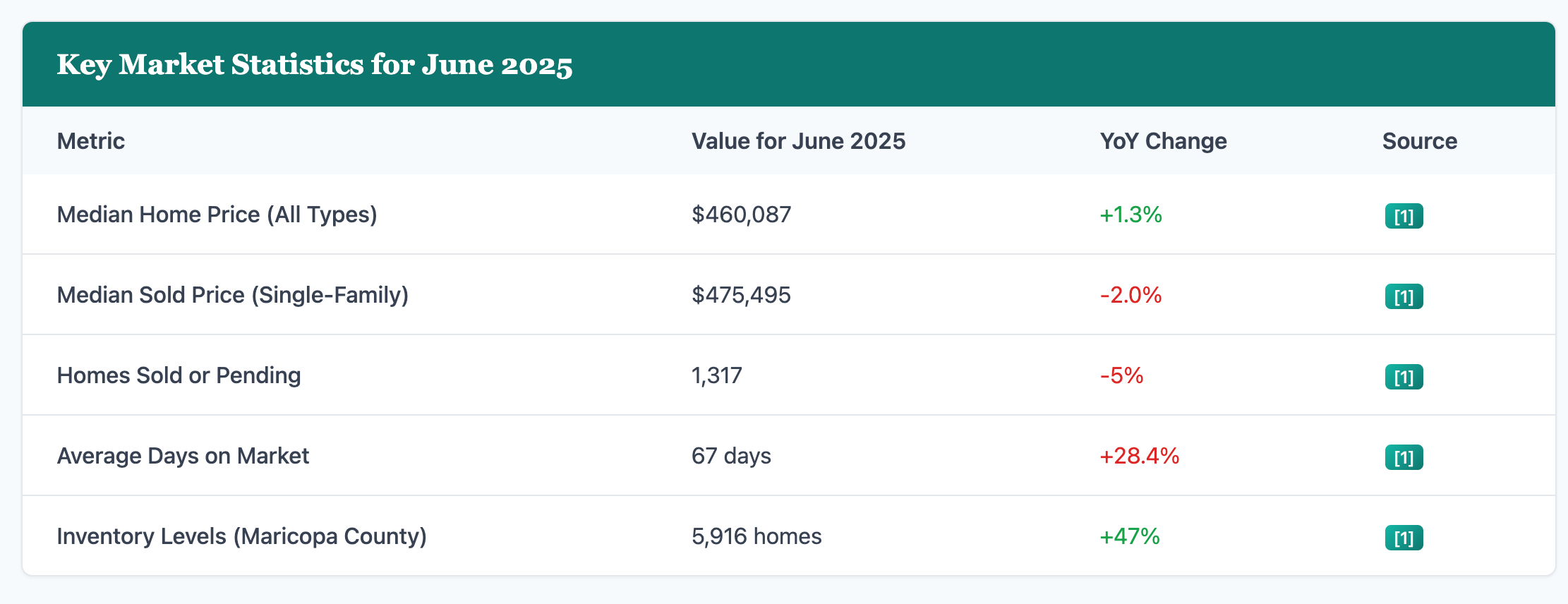

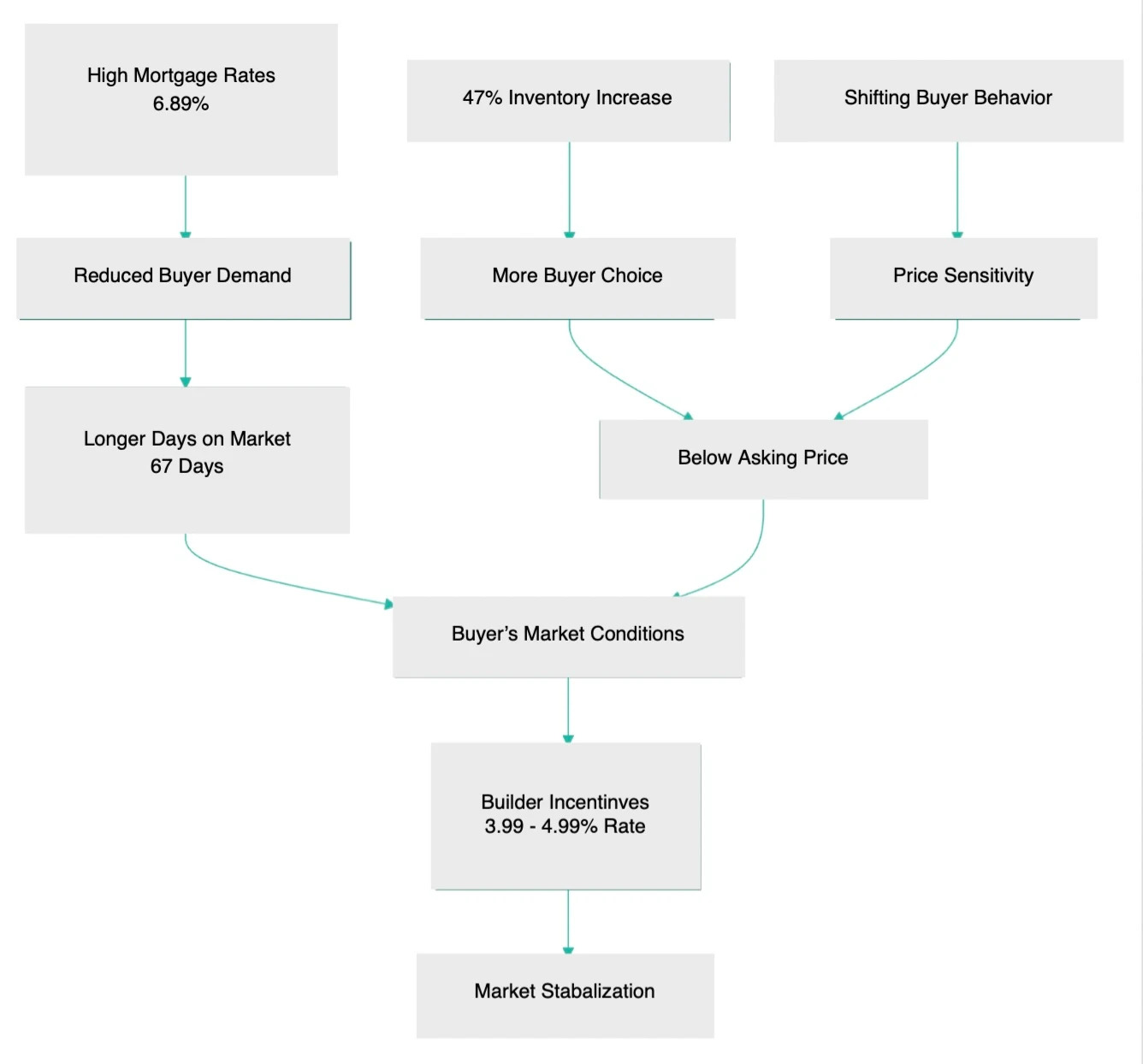

The Phoenix housing market in June 2025 has decisively shifted from a seller’s to a buyer’s market, a significant change from the highly competitive conditions of recent years. This transition is marked by a substantial increase in housing inventory, providing buyers with more choices and greater negotiating power.

Sales activity has cooled, with homes taking longer to sell and a majority selling below their initial asking price. High mortgage rates remain a key factor influencing affordability, though builders are actively using incentives to attract buyers. The market is undergoing a period of stabilization and recalibration rather than a sharp downturn, with regional variations, such as Scottsdale’s luxury market, showing different dynamics.

Market Overview: Cooling Trends and Increased Buyer Leverage

The Greater Phoenix real estate market in June 2025 has decisively transitioned into buyer’s market territory, a significant shift from the frenetic seller’s market that characterized previous years. This change is marked by a noticeable correction in home prices and a general slowdown in sales activity.

It is crucial to understand that this adjustment does not signify a market crash but rather a significant recalibration driven by a confluence of factors including high mortgage rates, a substantial increase in housing inventory, and evolving buyer behavior.

Pricing Trends and Affordability

The Phoenix metro area’s housing market in June 2025 exhibited clear signs of softening price trends, with various metrics indicating a shift from the rapid appreciation seen in previous years. While some headline figures showed modest year-over-year gains, a closer examination, particularly of median prices for single-family homes and price-per-square-foot, revealed a cooling in property values.

Inventory and Sales Activity

The Phoenix metro area’s housing market in June 2025 was characterized by significant shifts in inventory levels and sales activity, reflecting the ongoing transition towards a buyer’s market. Inventory levels saw a substantial year-over-year increase, providing buyers with a much wider selection of homes and greater leverage in negotiations.

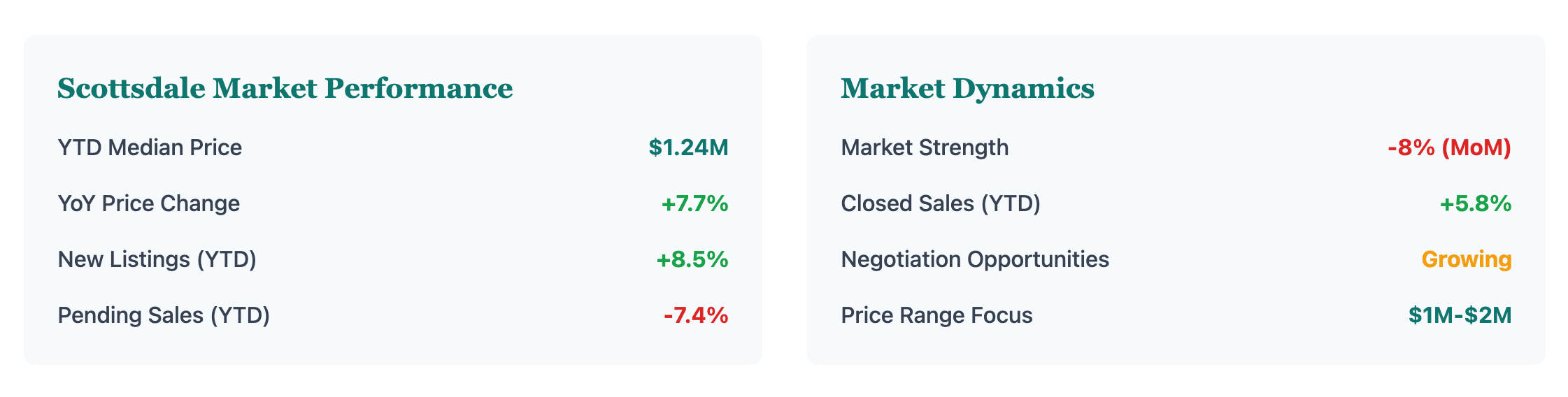

Regional Market Spotlight: Scottsdale

Scottsdale, a prominent and often high-value submarket within the broader Phoenix metropolitan area, continued to exhibit its characteristic premium pricing in June 2025. However, even this affluent market was not immune to the broader cooling trends affecting the region.

Market Shift Dynamics

Outlook and Forecast for 2025-2026

The outlook for the Phoenix housing market for the remainder of 2025 and into 2026 suggests a period of continued adjustment and cautious optimism, rather than a sharp downturn or a swift return to the heated conditions of previous years. Market experts anticipate that 2025 will be marginally better than 2024, which was considered the weakest market in recent history.

Market Classification

Cautiously Optimistic

Cooling but not crashing

Mortgage Rate Outlook

Expected to Drop

H2 2025 & 2026

Buyer Advantage

Continued

CMI at 73 (Buyer's Market)

Ready to see these deals in action? Step inside our Featured Listings , a gallery of Phoenix-area homes that are already priced 4-8 % below their spring highs. From move-in-ready Chandler Estates to investor-grade Tempe rental property, every listing is updated daily to reflect the latest price drops and builder incentives. Tap any photo to view 3-D tours, instant payment calculators, and one-click showing requests. Explore these Featured Listings here.

📞 Let’s talk! 480.731.4663 to Schedule a quick chat, text or email us to discuss your next move. I’d love the opportunity to help and answer any questions you may have regarding today’s market.

Advice for Buyers and Sellers

For Buyers

Leverage Your Position

With inventory up 47% year-over-year and homes taking longer to sell, buyers have “time and leverage” to negotiate favorable terms.

Negotiate Aggressively

60% of homes are selling below asking price, with buyers negotiating an average of $6,300 off list prices on a $450,000 home.

Explore Builder Incentives

New construction offers significant incentives, including mortgage rate buydowns as low as 3.99% to 4.99%.

For Sellers

Price Realistically

Overpricing can lead to properties languishing unsold. Phoenix had 33.2% of listings with price cuts in June.

Enhance Presentation

Proper staging and high-quality photography are more important than ever to stand out in a crowded market.

Be Prepared to Negotiate

Expect requests for repairs, upgrades, or concessions. Flexibility is crucial in the current market.