Buying your first home is a big milestone—and doing it in Arizona can be an excellent decision. The Grand Canyon State has become one of the most sought-after places to settle, thanks to its affordable housing (relative to other hot markets), steady job growth, and sunny climate. Whether you’re eyeing a single family home in Gilbert, a starter home in Chandler, or a quiet property in Scottsdale, Arizona offers plenty of opportunities for first-time buyers.

The good news? You don’t have to figure it all out alone. Partnering with an established real estate agent that has a great track record and can provide solid recommendations for mortgage brokers, title companies and walk you through the whole process is a step in the right direction. There are several programs to help first-time buyers with down payments, closing costs, and loan options. Let’s take a look at how we can help.

Who Qualifies as a First-Time Home Buyer in Arizona?

To qualify for first-time home buyer programs in Arizona, you must meet the standard definition used by most lenders and housing authorities:

You may still qualify if:

You previously owned a home but sold it over 3 years ago

You only owned a mobile home or manufactured home not affixed to a permanent foundation

You’re a single parent who only owned a home with your former spouse

You’re a displaced homemaker

This definition is accepted by most AZ home buyer programs, including those from the Arizona Housing Department and AZIDA.

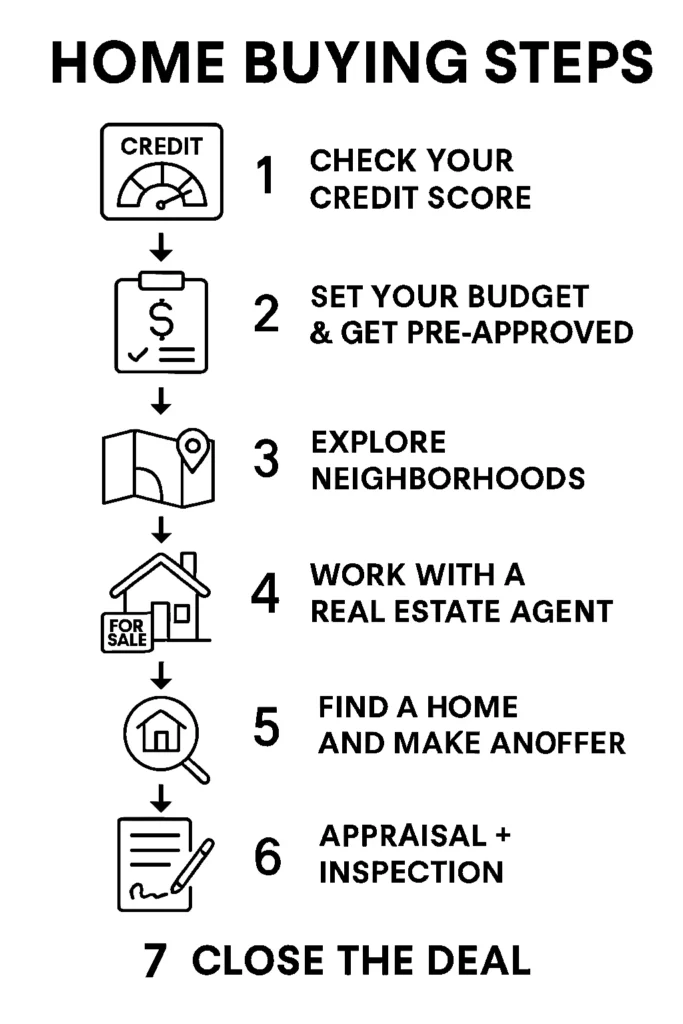

Step-by-Step Guide to Buying Your First Home in Arizona

1. Check Your Credit Score

Most programs require a score of 640 or higher, though some FHA loans accept 580+. You can check your score for free through most banks or credit monitoring services.

2. Set Your Budget and Get Pre-Approved

Use a mortgage calculator to determine affordability. Getting pre-approved makes you a serious buyer in the eyes of sellers and helps set realistic price expectations.

3. Explore Neighborhoods

Arizona has a wide variety of communities. A few of the more popular include:

Phoenix

Chandler & Gilbert

Cave Creek

4. Work With a Real Estate Agent

Find a local agent who specializes in first-time buyers and knows how to work with down payment assistance and Arizona home buying programs.

5. Find a Home and Make an Offer

Once you’re ready, start touring properties and make a competitive offer. Your agent will guide you through negotiations and contracts.

6. Appraisal and Inspection

These protect you and your partnered lender by making sure the home’s value and condition are sound.

7. Close the Deal

At closing, you’ll sign final documents, pay closing costs, and get the keys to your new home.

Find the Best First-Time Home Buyer Program in Arizona

When it comes to finances when considering purchasing your first home, working with a trusted mortgage broker is truly the first step. Below is a quick questionnaire that can provide some answers to see which down payment and closing cost assistance programs you may qualify for. It’s fast, secure, and tailored to first-time buyers in Arizona.

Current First-Time Buyer Market Conditions (2025)

📉 Average Home Prices

Phoenix Metro: $460,000

Mesa: $390,000

Chandler: $510,000

Scottsdale: $650,000

📊 Inventory & Competition

Inventory is increasing compared to 2022–2023 highs

Buyers now have more time and negotiation room

Interest rates are stabilizing near 6.2–6.5%

📈 Good News for First-Time Buyers

More affordable starter homes entering the market

Sellers offering concessions like closing cost credits

Many local lenders increasing first-time buyer incentives

Common Mistakes First-Time Buyers Make in Arizona

Skipping Pre-Approval

Is really not an option. Most sellers will not take you seriously when presenting an offer. And not knowing how much you can truly afford may price you out of a home you fall in love with.

Underestimating Closing Costs

Budget an extra 2–5% of the home price for taxes, title fees, and lender costs.

Waiving Inspections

As with any home, there can be potential issues. It's always recommended that you have a home inspection written into your purchase agreement. It's good insurance.

Overextending Budget

Don’t forget ongoing costs like HOA dues, maintenance, and property taxes.

Not Researching HOA Rules

Some communities have strict rules that may affect your lifestyle or renovation plans.

Frequently Asked Questions

Can I buy a house in Arizona with no money down?

Yes. Programs like VA and USDA loans allow 0% down. Some buyers can stack down payment assistance Arizona programs to cover upfront costs.

What credit score do I need to buy a house in Arizona?

Minimums vary:

FHA: 580

Conventional: 620

Down payment assistance programs: Usually 640+

Are there grants for first-time home buyers in Phoenix?

Yes. The Home in Five and HOME Plus programs both offer grant-style assistance. Income limits and location rules apply.

What’s the average down payment on a house in AZ?

Most first-time buyers pay 3%–5% of the home price. With assistance, this can be reduced or covered entirely.

Can I use first-time buyer programs with FHA loans?

Absolutely. FHA loans work with most Arizona first time home buyer programs and are a popular pairing.

Your First Home in Arizona Is Within Reach

The path to homeownership doesn’t have to be overwhelming. With the right programs, loan options, and expert guidance, you can become a first-time home buyer in Arizona without breaking your budget.

Need help getting started? Bryan Staley and the team at Phoenix Homes specialize in helping first-time buyers navigate the Arizona market—from pre-approval to move-in day.

👉 Schedule a free consultation today to get personalized recommendations, explore local listings, and learn which az home buyer programs are right for you.