The Phoenix housing market closed 2025 on a remarkably strong note, with December delivering the best absorption rate in over a year while prices maintained their year-long stability. Building on the foundation established in our November 2025 Phoenix Housing Market Report, the Greater Phoenix real estate market demonstrated that balanced conditions and robust buyer activity can coexist. The median home price held firm at $450,000—unchanged for an entire year—while sales volume surged and inventory normalized to healthier levels. This December 2025 Phoenix housing market report delivers comprehensive analysis for home buyers, sellers, and real estate investors navigating the Valley’s evolving landscape.

Key Takeaways:

- Median home price: $450,000 (0.0% year-over-year) – Remarkable price stability continues, with the median sales price exactly matching December 2024, demonstrating a sustainable market floor.

- Active inventory: 21,734 homes (+11.77% year-over-year) – Inventory has normalized from summer peaks, declining nearly 11% from November while still providing buyers ample choices.

- Days on market: 63 days median (+10.53% from Dec 2024) – Homes are taking slightly longer to sell than last year, though December showed improvement from recent months.

- Market supply: 3.48 months (-2.24% year-over-year) – Supply has tightened significantly, dropping nearly 25% from November and approaching seller-favorable territory.

- Absorption rate: 28.75% (+2.29% year-over-year) – The strongest absorption rate in over 12 months signals robust buyer demand heading into 2026.

- Sold listings: 6,249 homes (+14.32% year-over-year) – December sales volume exceeded last year’s pace significantly, showing sustained transaction activity.

📺 Watch the Video Overview

Prefer to watch instead of read? Our December 2025 Phoenix Housing Market video breaks down all the key stats and trends in just a few minutes. See charts, expert commentary, and actionable insights for buyers, sellers, and investors.

Phoenix’s housing market enters 2026 from a position of unexpected strength. After a year characterized by elevated inventory and cautious buyers, December’s data reveals a market finding its rhythm. The combination of stable prices, healthy transaction volume, and improving absorption metrics suggests that the recalibration period may be nearing completion. While mortgage rates hovering near 7% continue to moderate some purchasing power, the Valley’s fundamental strengths—robust job growth in healthcare, technology, and semiconductor manufacturing—continue supporting housing demand. Greater Phoenix real estate has demonstrated resilience, offering both buyers and sellers a predictable environment where realistic expectations lead to successful outcomes.

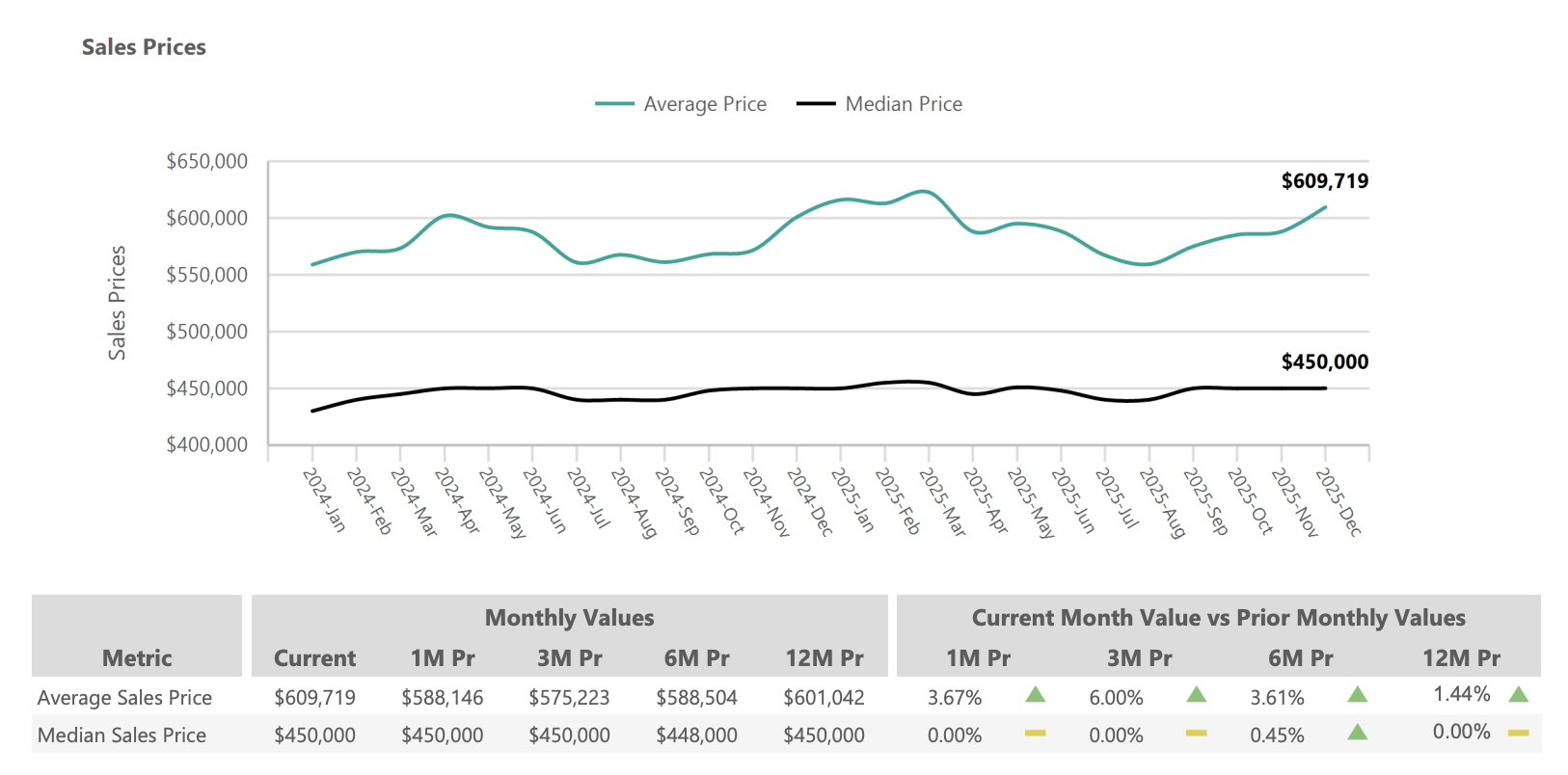

Phoenix Home Prices December 2025: A Year of Stability

1- Current Pricing Trends

Phoenix home prices delivered their most consistent year in recent memory, with the median sales price holding steady at $450,000 in December 2025—exactly matching December 2024. This flat year-over-year performance caps a remarkable 12-month period of price stability that has confounded both the pessimists who predicted crashes and the optimists who expected rapid appreciation. The market has instead charted a middle course: sustainable, predictable, and resilient.

The average sales price reached $609,719, up a healthy 1.44% from December 2024’s $601,042. This modest increase in the average while the median holds flat indicates continued activity in the luxury segment, where high-end Scottsdale and Paradise Valley properties lift the overall average without materially impacting typical market conditions. For the median Phoenix homebuyer, the message remains clear: prices have stabilized at a level that both buyers and sellers consider fair.

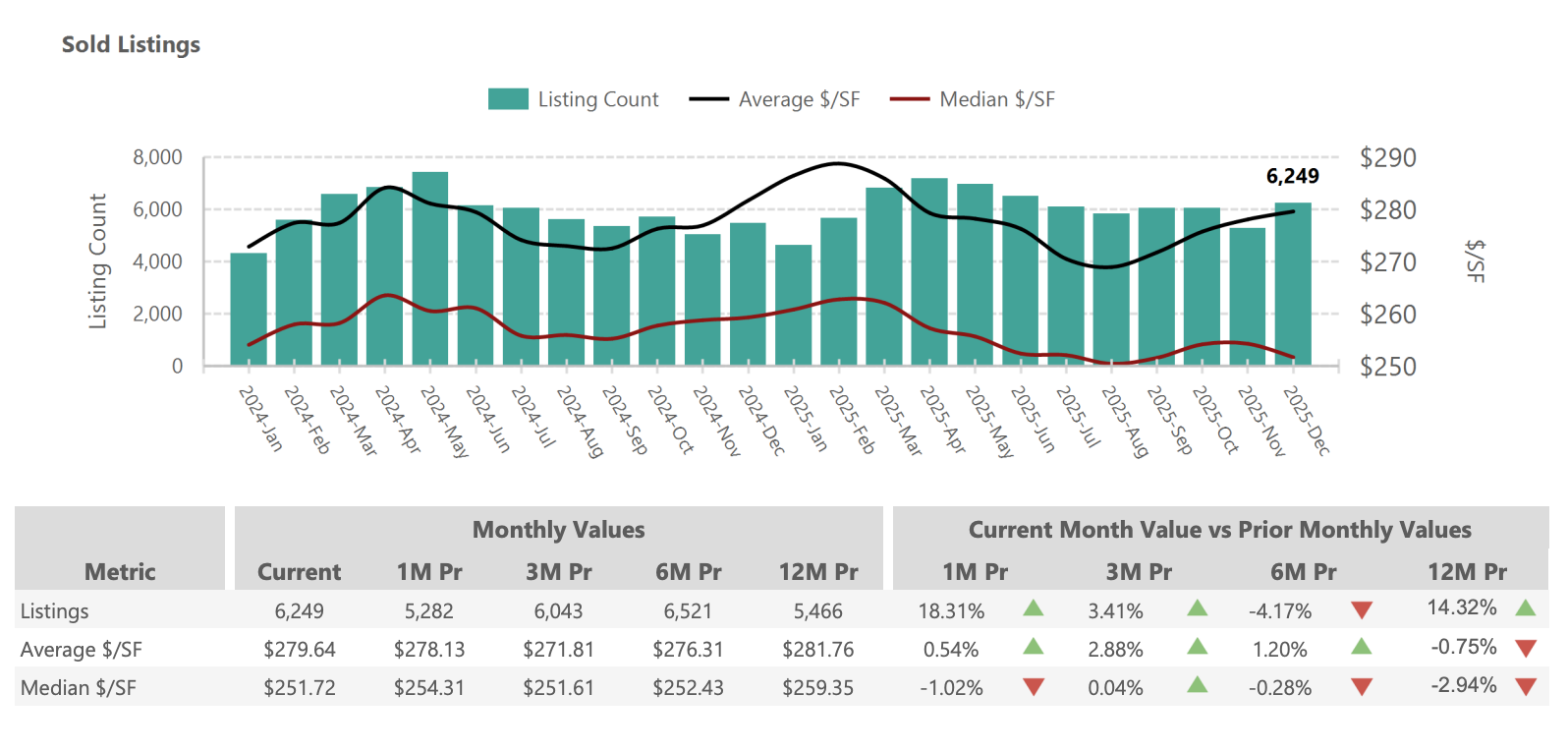

Price per square foot metrics paint a nuanced picture of December’s market. The average sold price per square foot stands at $279.64, up 0.54% from November and down just 0.75% from a year ago. The median sold price per square foot sits at $251.72, down 2.94% year-over-year, suggesting that per-square-foot values have softened modestly even as total home prices hold firm. This dynamic often indicates buyers gravitating toward larger homes at stable total prices.

December 2025 Price Metrics:

- Median Sales Price: $450,000 (0.0% YoY)

- Average Sales Price: $609,719 (+1.44% YoY)

- Average $/SF (Sold Homes): $279.64 (-0.75% YoY)

- Median $/SF (Sold Homes): $251.72 (-2.94% YoY)

2- Historical Context: The Plateau Holds

The current median price of $450,000 remains approximately 6% below Phoenix’s all-time high of roughly $480,000 reached in May 2022. More significantly, it represents a level the market has maintained with remarkable consistency since late 2024. This “controlled plateau” represents one of the softest landings in Phoenix real estate history, particularly when compared to the catastrophic 50%+ decline during the 2008-2011 housing crisis.

What makes this stability particularly notable is its persistence through challenging conditions. Mortgage rates more than doubled from their pandemic lows. Active inventory surged to levels not seen since 2014-2015. Economic uncertainty created headlines throughout 2025. Yet through it all, Phoenix home prices neither crashed nor surged—they simply held.

This stability speaks to Phoenix’s underlying fundamentals. Unlike the speculative bubble that preceded 2008, today’s market is supported by genuine demographic demand, consistent job creation, and housing supply that—while elevated—hasn’t dramatically overshot population growth. The Valley’s economy has diversified significantly over the past decade, reducing vulnerability to single-sector shocks and providing multiple pillars of housing demand support.

3- Local Market Variations

Price performance varies meaningfully across Greater Phoenix’s diverse submarkets, creating opportunities and challenges depending on where you’re shopping or selling.

Scottsdale and Paradise Valley continue commanding premium prices with modest appreciation. The luxury segment ($1M+) has shown particular resilience, with cash buyers and high-net-worth relocators maintaining demand for trophy properties. Limited land availability and best-in-class amenities support values even when the broader market softens.

Gilbert and Chandler remain magnets for families prioritizing excellent schools and newer construction. Prices in these East Valley communities have held steady to slightly soft, with median values around $550,000-$570,000. The additional inventory here gives buyers meaningful negotiating leverage they didn’t have in previous years.

West Valley communities like Buckeye, Goodyear, and Surprise offer the most affordable entry points in Greater Phoenix, with median prices in the $380,000-$420,000 range. These markets have experienced the most pronounced inventory buildup and longest days on market, reflecting affordability pressures that higher rates create for first-time buyers.

Central Phoenix and Tempe show mixed conditions. Gentrifying urban core neighborhoods have maintained values supported by young professional and empty-nester demand, while some older areas have experienced modest softening. The strong rental market continues attracting investor interest in these urban locations.

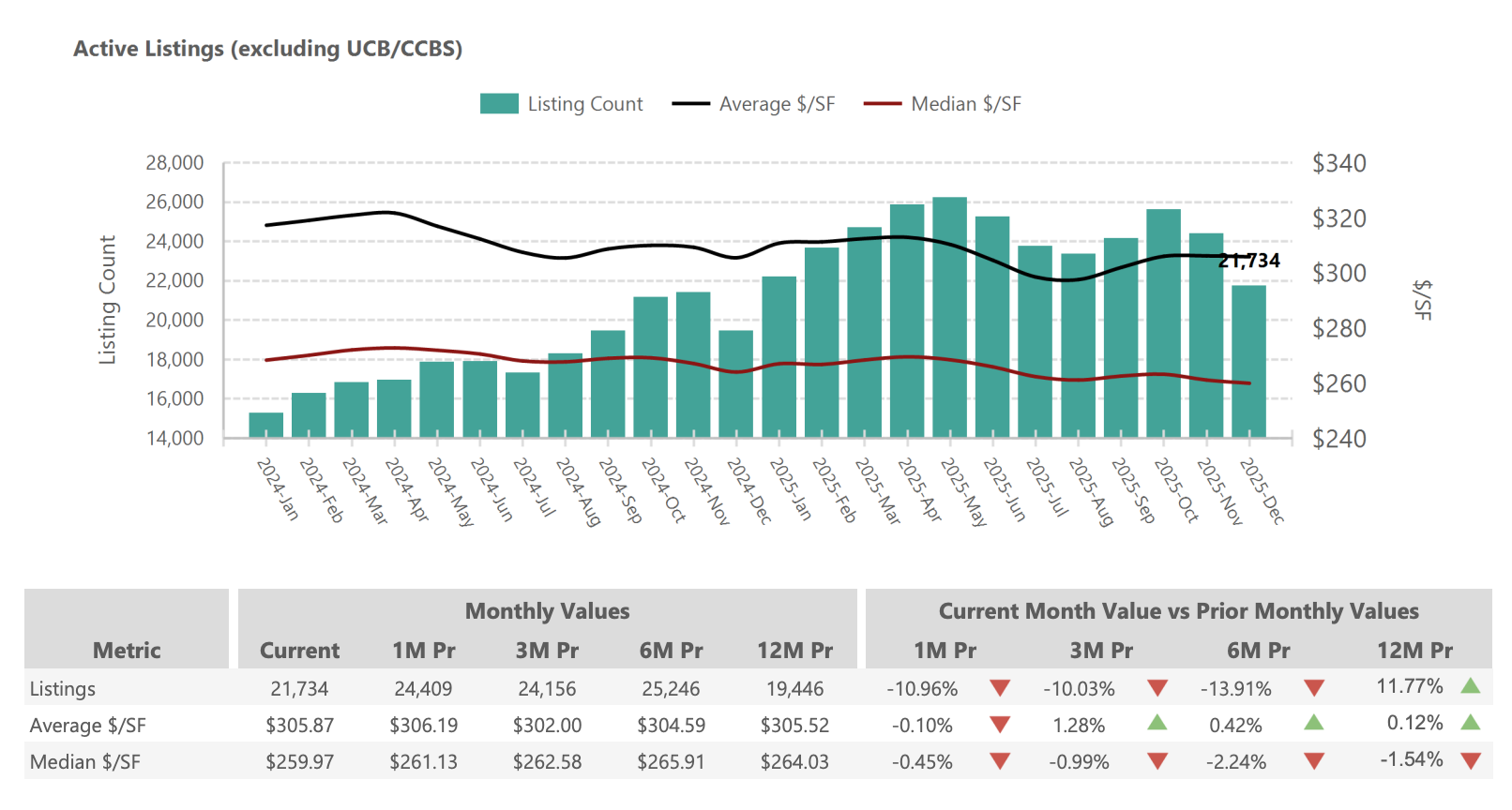

Phoenix Housing Inventory December 2025: The Return to Balance

1- Inventory Trends and Analysis

Active inventory in November 2025 reached approximately 24,394 homes for sale across Greater Phoenix—up 14% from November 2024’s count of roughly 21,400, but down about 5% from October 2025’s peak near 25,600. This pattern suggests the inventory surge that characterized much of 2024 and early 2025 may be stabilizing, with supply and demand finding a new equilibrium.

Buyers now have access to more homes than at any time since 2014-2015, fundamentally transforming the shopping experience. The scarcity-driven frenzy of 2021-2022, when buyers competed fiercely for a handful of listings, has given way to a market where choice abounds. Today’s buyer can view a dozen homes over several weekends, carefully compare features and pricing, and select a property that genuinely meets their needs rather than settling for “whatever is available.”

December 2025 Inventory Metrics:

- Active Listings: 21,734 homes (+11.77% YoY, -10.96% from Nov)

- New Listings (Added in Dec): 5,764 (+7.58% YoY, -21.12% from Nov)

- Months of Supply: 3.48 months (-2.24% YoY, -24.74% from Nov)

- Absorption Rate: 28.75% (+2.29% YoY, +32.87% from Nov)

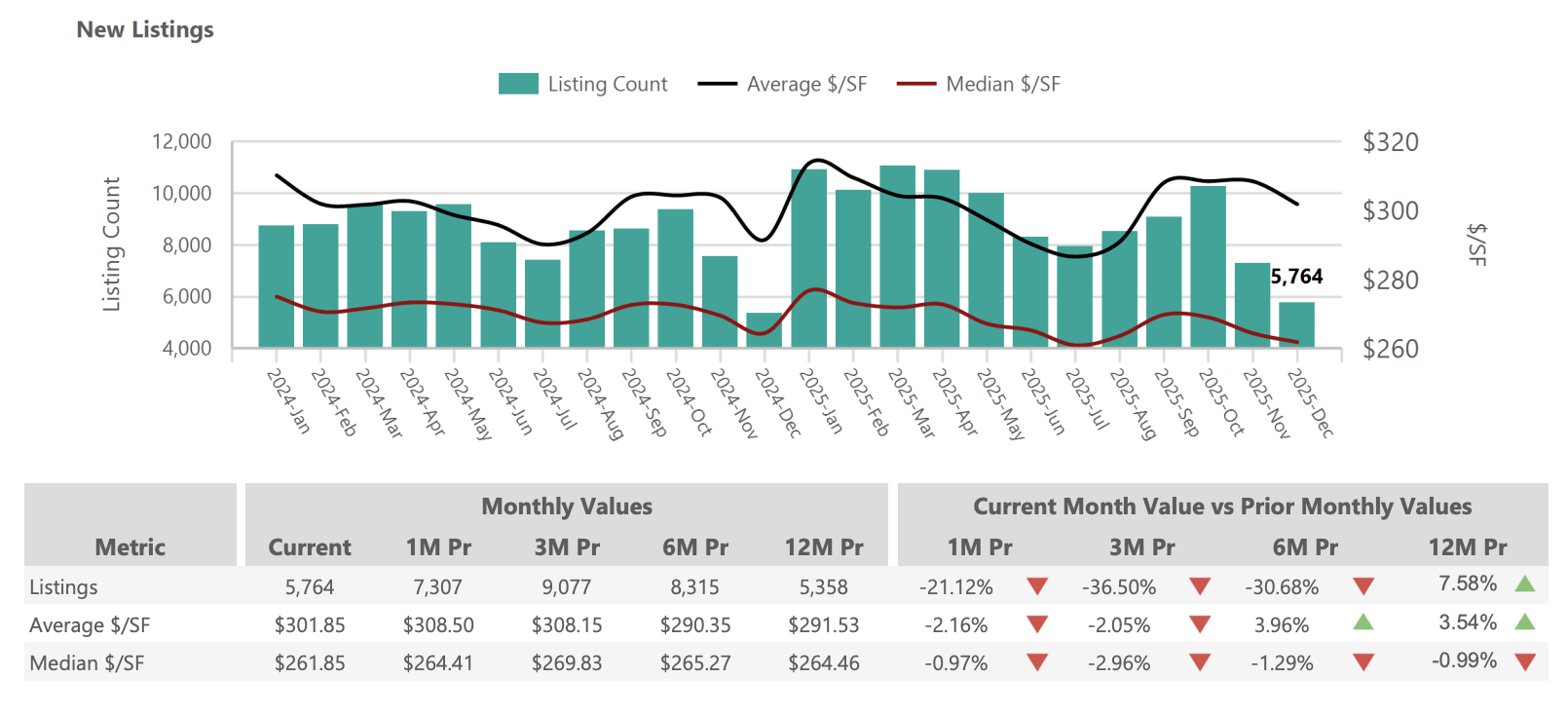

2- Seasonal Patterns and New Listing Activity

December’s 5,764 new listings represent a substantial 21.12% decline from November’s 7,307 new listings—an expected seasonal slowdown as the holidays approach and fewer homeowners choose to list during the winter months. Year-over-year, however, December 2025’s new listing count rose 7.58% from December 2024’s 5,358, suggesting underlying seller confidence remains healthy.

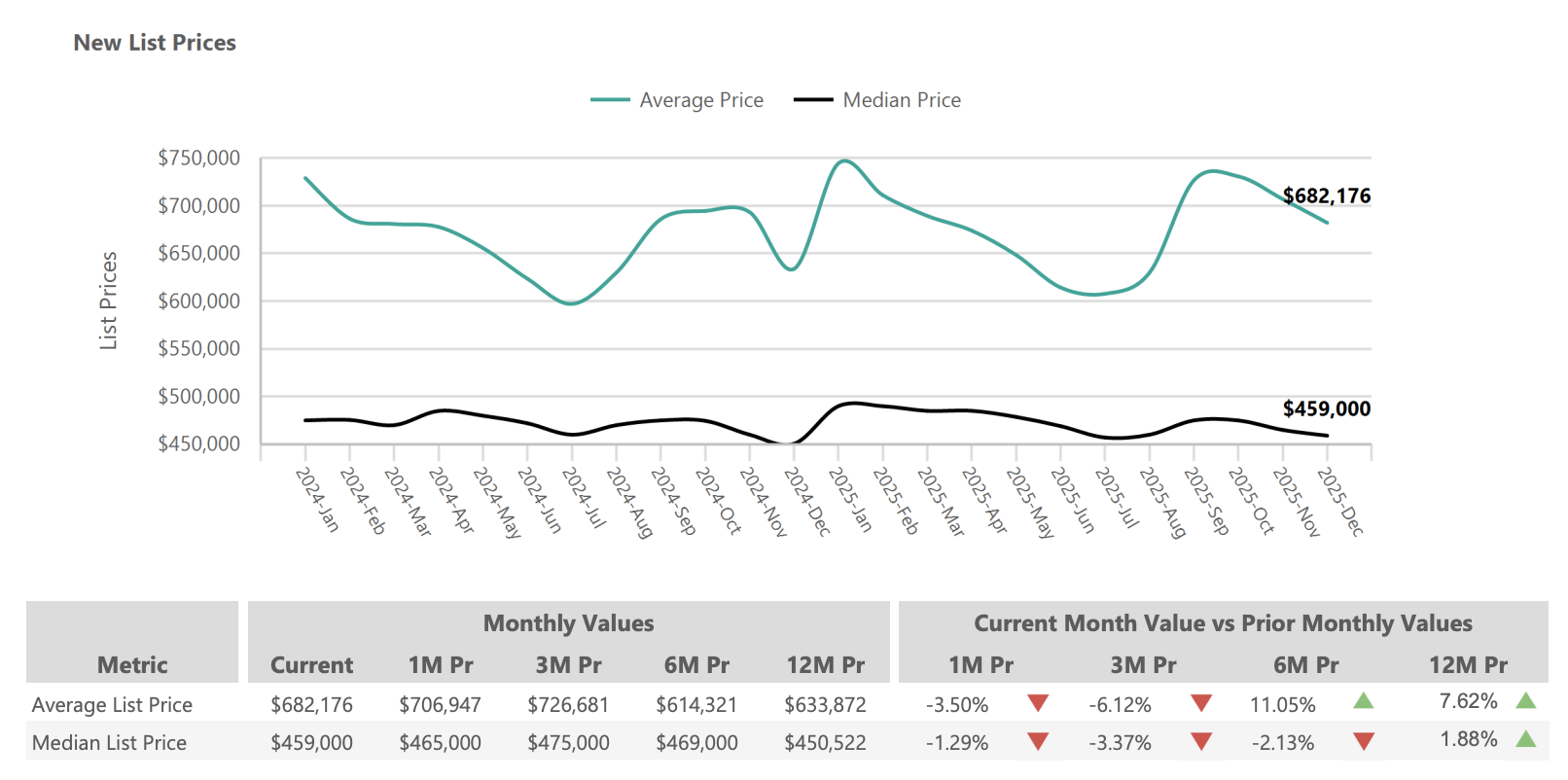

The average list price for December’s new listings stood at $682,176 (up 7.62% YoY), while the median list price was $459,000 (up 1.88% YoY). These asking prices slightly exceed typical sale prices, reflecting the normal spread between initial asks and final negotiations in today’s buyer-friendly market.

3- Supply and Demand Balance: The Critical Shift

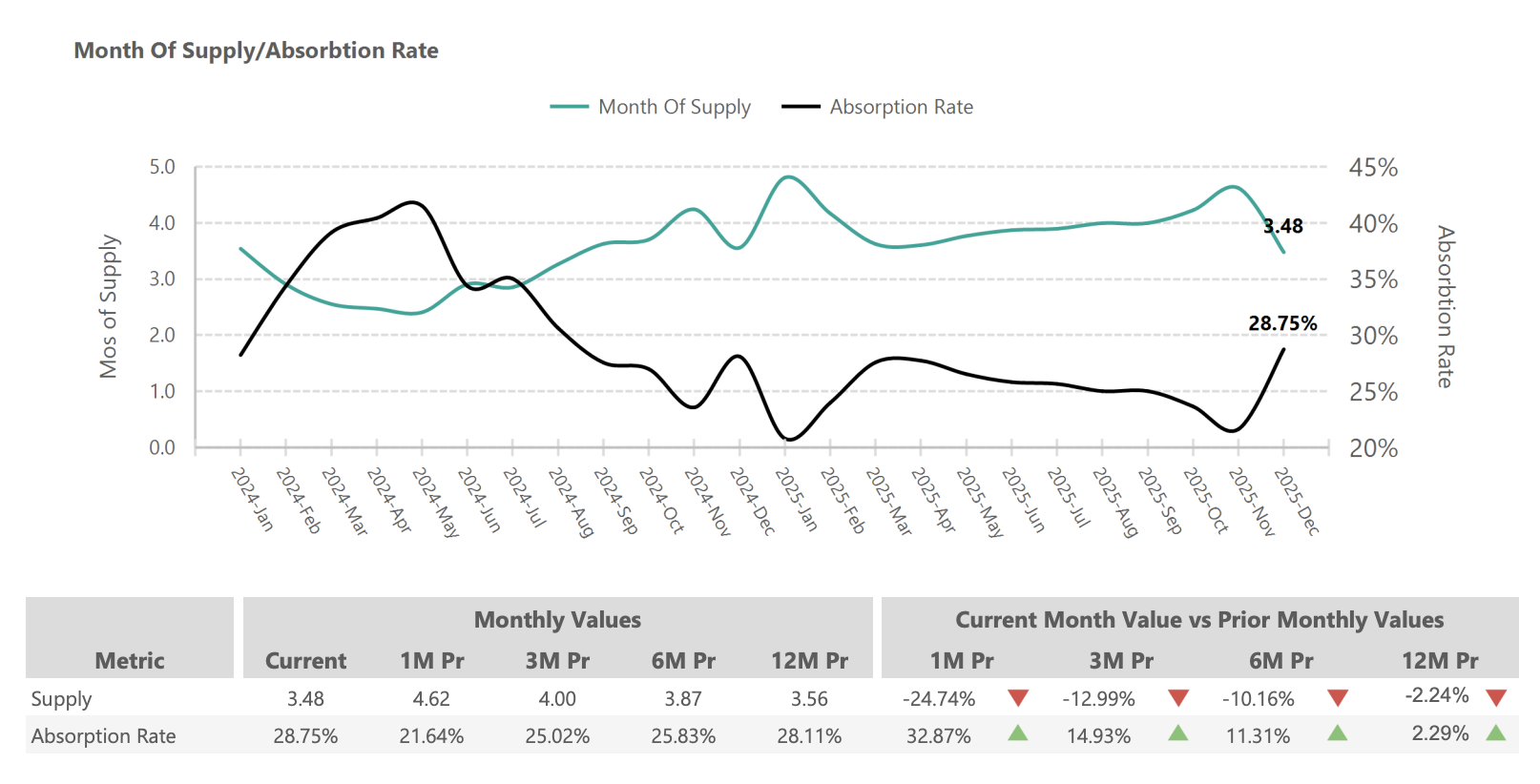

The 3.48 months of supply in December 2025 represents a significant tightening from November’s 4.62 months—a 24.74% month-over-month improvement. This shift moves the market closer to seller-favorable territory. Real estate economists generally consider 4-6 months of supply indicative of a balanced market; below 4 months typically signals conditions beginning to favor sellers.

The absorption rate of 28.75% is the headline story of December’s data. This figure—meaning nearly 29% of all active inventory sold during the month—represents the strongest absorption since early 2024. The 32.87% improvement from November’s 21.64% absorption rate indicates significant buyer momentum as the year closed. For comparison, during the pandemic frenzy of 2021, absorption rates regularly exceeded 50%; December’s 28.75% sits roughly halfway between those extraordinary levels and the more tepid rates seen in mid-2025.

4- Sold Listings: December's Strong Finish

December 2025 saw 6,249 closed sales, up an impressive 14.32% from December 2024’s 5,466 closings. This robust year-over-year increase demonstrates that buyer activity has genuinely strengthened, not merely redistributed from earlier months. The market isn’t just maintaining pace—it’s accelerating.

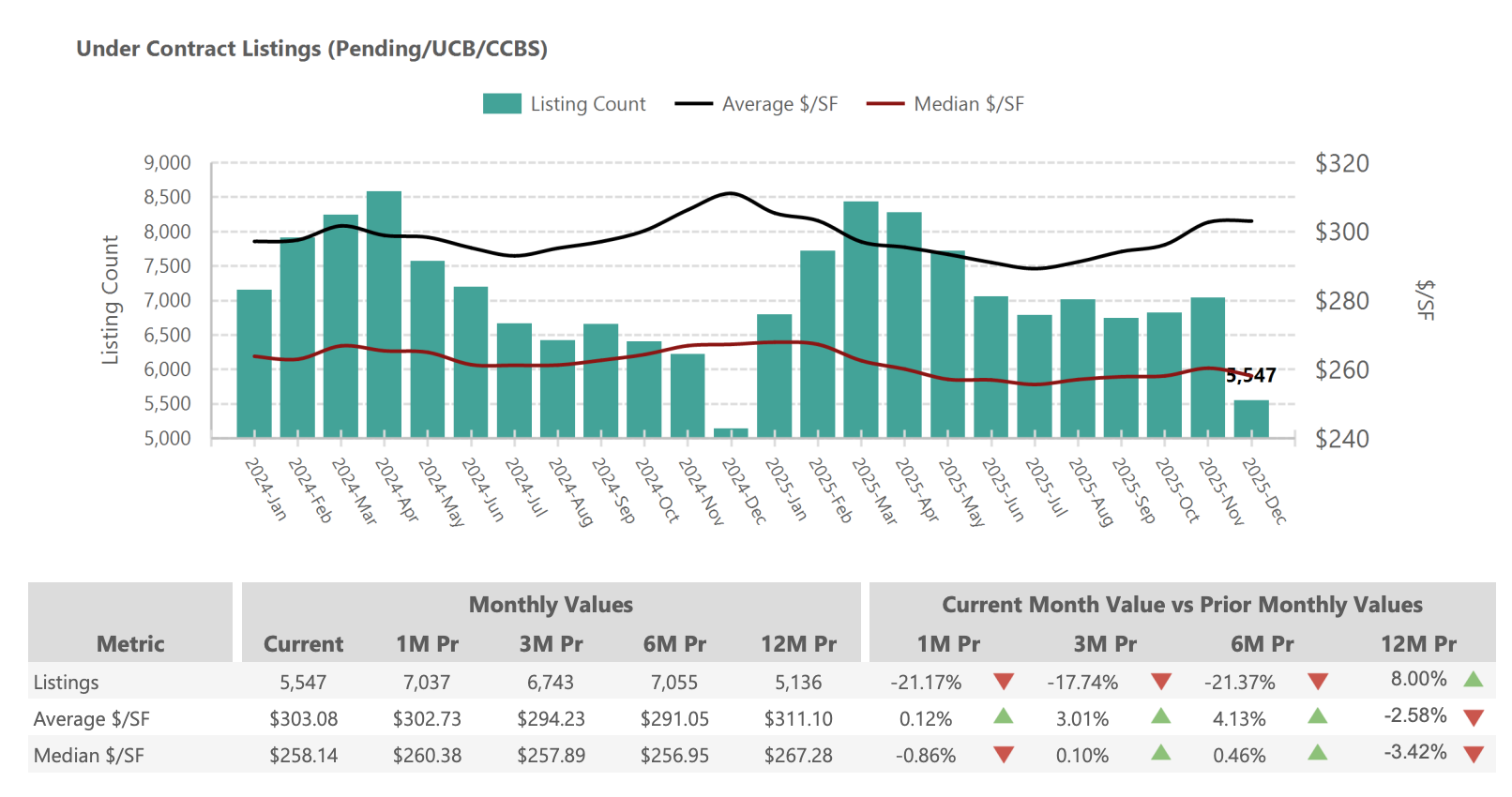

The under-contract (pending) count of 5,547 homes provides forward-looking insight into January 2026’s expected closings. While this figure is down 21.17% from November’s 7,037 pending sales—a natural consequence of December’s heavy closing activity—it remains up 8% year-over-year, suggesting continued healthy momentum into the new year.

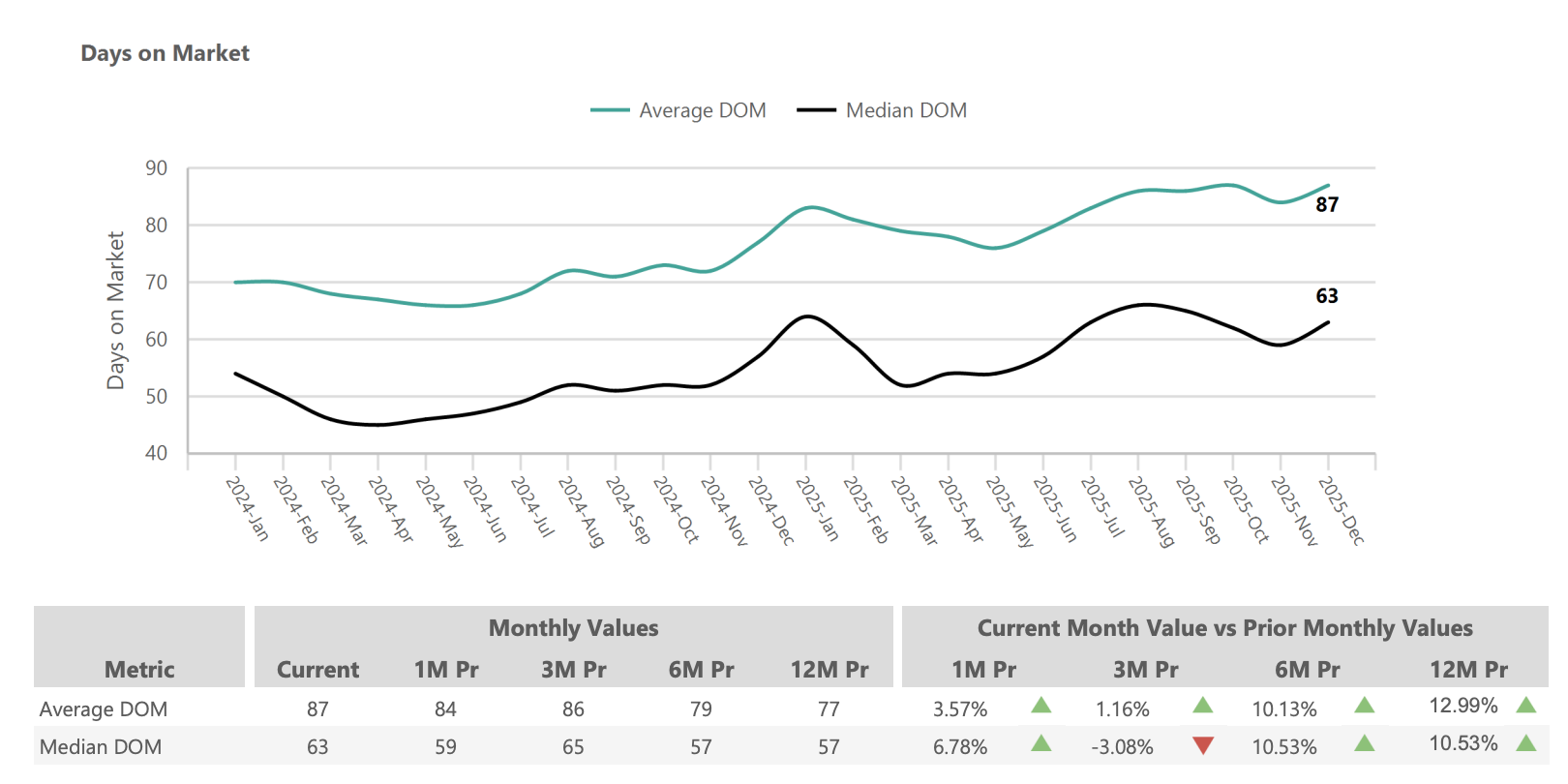

Days on Market: Finding the Right Buyer in December 2025

1- Current Selling Timeframes

Homes in Phoenix are taking longer to sell than they did a year ago, though December showed stability relative to recent months. The median days on market (DOM) reached 63 days, up from 57 days in December 2024—a 10.53% increase. The average DOM sits at 87 days, up 12.99% from 77 days a year prior.

December’s figures improved slightly from November (median 59 days, average 84 days) despite typical holiday slowdowns, suggesting that motivated buyers are actively transacting rather than waiting. The improvement in absorption rate confirms this pattern: the pipeline is moving faster, even as individual listings take somewhat longer to find their match than during last year’s more constrained inventory environment.

December 2025 Days on Market Data:

- Median DOM: 63 days (was 57 days in Dec 2024, +10.53% YoY)

- Average DOM: 87 days (was 77 days in Dec 2024, +12.99% YoY)

- Month-over-month: Slight increase from November (median 59 days → 63 days)

2- What Sells Quickly vs. What Lingers

Not all properties experience the same selling timeline. Properties that sell within 30 days typically share common characteristics: competitive pricing (at or slightly below recent comparable sales), excellent condition (updated, move-in ready), desirable locations (good schools, convenient commutes), and strong marketing (professional photography, strategic online presence).

Properties that linger for 60+ days often suffer from one or more challenges: overpricing relative to condition or location, deferred maintenance or dated finishes, challenging locations (busy streets, commercial adjacency, inferior school districts), or marketing that fails to showcase the home’s best features.

For sellers, the lesson is clear: invest in preparation and pricing strategy. A well-prepared, competitively priced home can still attract offers within weeks, even in this market. But hoping that buyers will overlook flaws or overpay for perceived value is a recipe for extended market time and eventual price reductions.

Economic Drivers: Why Phoenix Real Estate Remains Resilient

Understanding the economic forces supporting Phoenix’s housing market helps explain why prices have stabilized rather than crashed despite dramatically higher interest rates and expanded inventory.

Employment Growth Continues

The Phoenix metro area continues adding jobs, with employment now exceeding 2.4 million positions. Year-over-year job growth of 1.2-1.5% outpaces most major metros, providing the income growth that supports housing purchases. The unemployment rate remains at a healthy 3.1%—among the lowest in the nation.

Key growth sectors include healthcare (now representing 14% of metro employment), professional and business services, technology, and construction. The healthcare sector alone has added tens of thousands of positions as the growing population requires expanded medical infrastructure.

The Semiconductor Boom

Phoenix has emerged as a crucial node in the nation’s semiconductor manufacturing renaissance. TSMC’s massive fabrication facilities in North Phoenix represent the largest foreign investment in Arizona history, with production ramping up and additional fabs under construction. Intel continues expanding its Chandler campus. These investments create high-paying jobs—semiconductor engineers, technicians, and support staff—who become home buyers.

The ripple effects extend beyond the fabs themselves. Suppliers, service providers, and related businesses are establishing Phoenix operations. Housing demand from this sector should persist and grow as production continues ramping through 2026 and beyond.

Population Growth Persists

Greater Phoenix’s population now exceeds 4.8 million, having grown by nearly 2 million people over the past 25 years. While the torrid growth rates of 2020-2022 have moderated, inflows continue—particularly from California, Washington, Illinois, and New York. The metro area consistently ranks among the nation’s fastest-growing, adding household formation that creates baseline housing demand.

Actionable Advice for Market Participants

The December 2025 data confirms that Phoenix has transitioned from a balanced market toward one beginning to favor sellers again. With the absorption rate surging to 28.75%, supply dropping to 3.48 months, and sales volume up 14% year-over-year, conditions are tightening. In this environment, success depends on understanding current dynamics and adapting strategy accordingly.

For Buyers

Opportunities in the Current Market

- Still Meaningful Selection: With 21,734+ active listings, buyers retain substantial choice compared to the scarcity of 2021-2022. However, the window of maximum negotiating power may be closing—inventory is down 11% from November and trending lower.

- Price Stability Continues: The median price has held at $450,000 for 12 months. This predictability allows for thoughtful decision-making without fear that prices will run away. Include inspection and appraisal contingencies; use the extended DOM to conduct thorough due diligence.

Strategic Recommendations for Buyers

- Act with Purpose: The improving absorption rate suggests more competition ahead. Get pre-approved, know your target neighborhoods, and be prepared to make strong offers on properties that meet your criteria.

- Target Motivated Sellers: Properties with 45+ days on market or recent price reductions offer negotiating opportunities. These sellers have received market feedback and may be flexible.

- Consider Seller Concessions: Rather than focusing solely on purchase price, negotiate for closing cost contributions or rate buydowns that reduce your monthly payment.

For Sellers

Current Market Realities

- Conditions Are Improving: The 28.75% absorption rate represents the strongest buyer activity in over a year. If you’ve been waiting for better conditions to sell, they’re arriving.

- Pricing Still Matters: Despite improving conditions, overpriced homes still linger. The market rewards competitive pricing—price to attract buyers, not to test the ceiling.

Success Strategies for Sellers

- Price Competitively: Study recent comparable sales and price at or slightly below market. The first 2-3 weeks of exposure are crucial.

- Invest in Presentation: Declutter, deep clean, address deferred maintenance, and invest in professional photography. With improving absorption, a well-presented home can sell faster than you might expect.

- Consider Timing: Listing in January-February 2026 positions your home for spring buyer activity. Inventory typically remains lower in winter, reducing your competition.

For Investors

Market Opportunities

- Tightening Conditions: The improving absorption rate and declining inventory suggest the easiest acquisition opportunities may be fading. Investors who have been waiting may want to act before competition increases.

- Strong Rental Demand: Phoenix’s rental market remains robust, supported by population growth and job creation. Buy-and-hold strategies benefit from reliable cash flow.

Risk Management

- Account for Higher Financing Costs: Interest rates near 7% significantly impact investment returns. Run conservative numbers and ensure deals pencil at current rates, not hoped-for future rates.

- Focus on Fundamentals: Target properties with strong rental demand, good locations, and appropriate unit sizes. The investors who will thrive are those who buy right and manage well.

Conclusion: 2026 Outlook and Final Thoughts

The Phoenix housing market closed 2025 with unexpected strength, delivering December data that exceeded many analysts’ expectations. The combination of stable prices at $450,000, surging absorption at 28.75%, and sales volume up 14% year-over-year suggests that the recalibration period of 2024-2025 may be nearing completion.

Key Market Themes Heading into 2026:

- Tightening Conditions: Supply is declining, absorption is rising, and the balance is shifting modestly toward sellers.

- Price Stability Remains: Despite improving conditions, dramatic price increases seem unlikely given affordability constraints from elevated mortgage rates.

- Strong Fundamentals: Phoenix’s job growth, population inflows, and economic diversification continue supporting housing demand.

- Rate Sensitivity: The trajectory of mortgage rates will significantly influence 2026’s market. Any meaningful rate declines could accelerate buyer activity.

For buyers, the current environment offers the opportunity to purchase without panic—but the window of maximum negotiating leverage may be narrowing. For sellers, improving conditions reward those who price and present their homes competitively. For investors, disciplined fundamentals remain the path to success.

For personalized insights or guidance on navigating this market, reach out to the Phoenix real estate experts at PhoenixHomes.com. Our team stays current on the latest data and can help you craft the right strategy—whether you’re timing a sale for optimal results, negotiating your next home purchase, or building an investment portfolio in Greater Phoenix. The market is evolving, but with the right knowledge and experienced partners, your real estate goals remain achievable.