The Phoenix housing market in October 2025 continues its shift toward equilibrium, characterized by steady prices, abundant inventory, and moderate sales activity. After the frenzied seller’s market of 2021-2022, Greater Phoenix has settled into balanced conditions where buyers have increased leverage and sellers face more competition. Home prices remained essentially flat year-over-year while active listings held near historically high levels, indicating that demand is keeping pace with the expanded supply. This report builds on insights from the September 2025 Phoenix Housing Market Report and highlights the latest trends for buyers, sellers, and investors in the Greater Phoenix real estate market.

Key Takeaways:

Median home price: $450,000 (+0.4% year-over-year) – effectively unchanged from October 2024, demonstrating price stability after last year’s slight correction.

Active inventory: ~25,500 homes (+5% year-over-year) – inventory remains elevated versus a year ago, providing buyers with ample choices (though the annual growth in listings has leveled off).

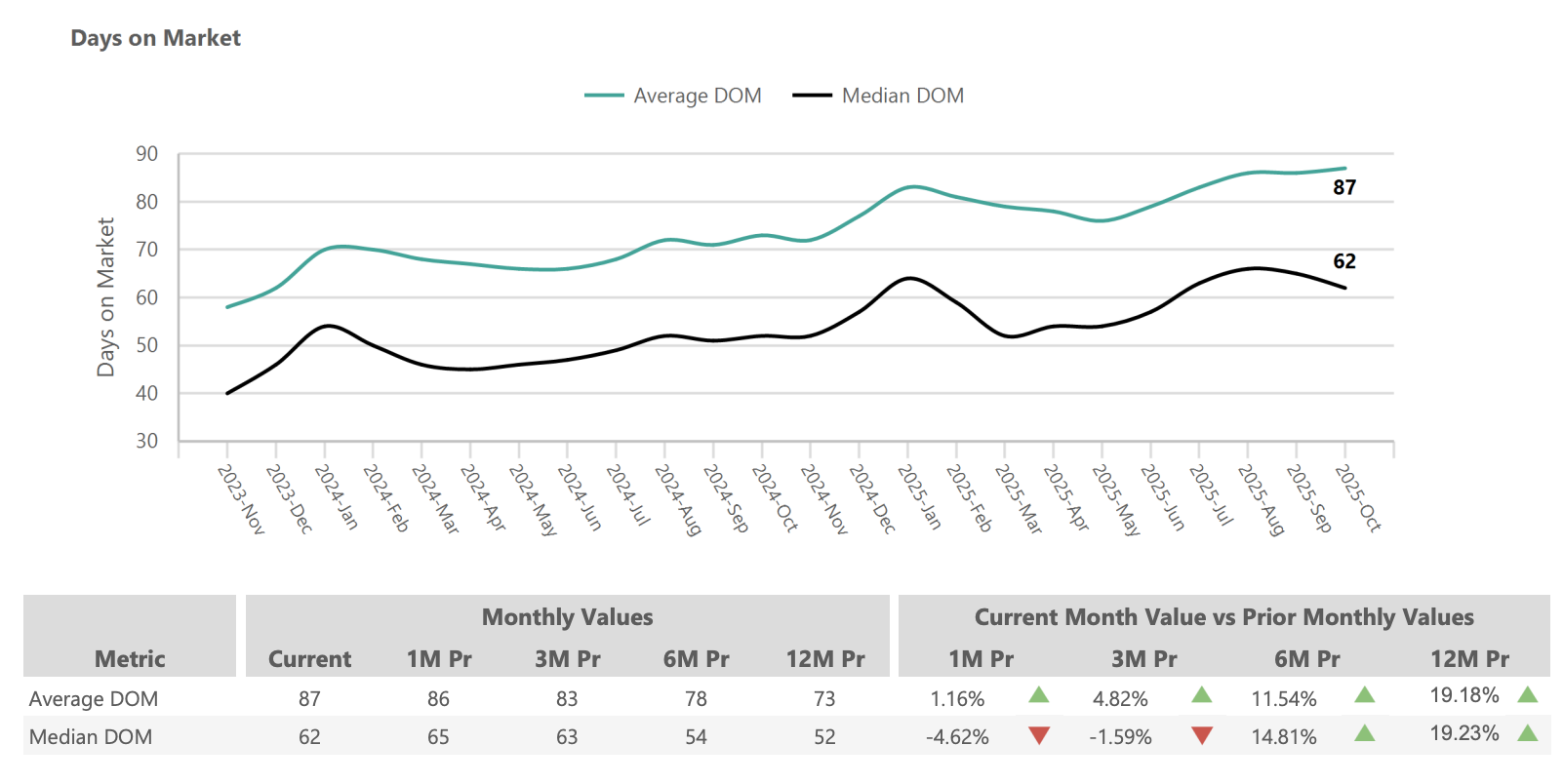

Days on market: 65 days median (+19% from Oct 2024) – homes are taking about two weeks longer to sell on average than they did a year ago, reflecting a less hurried market pace.

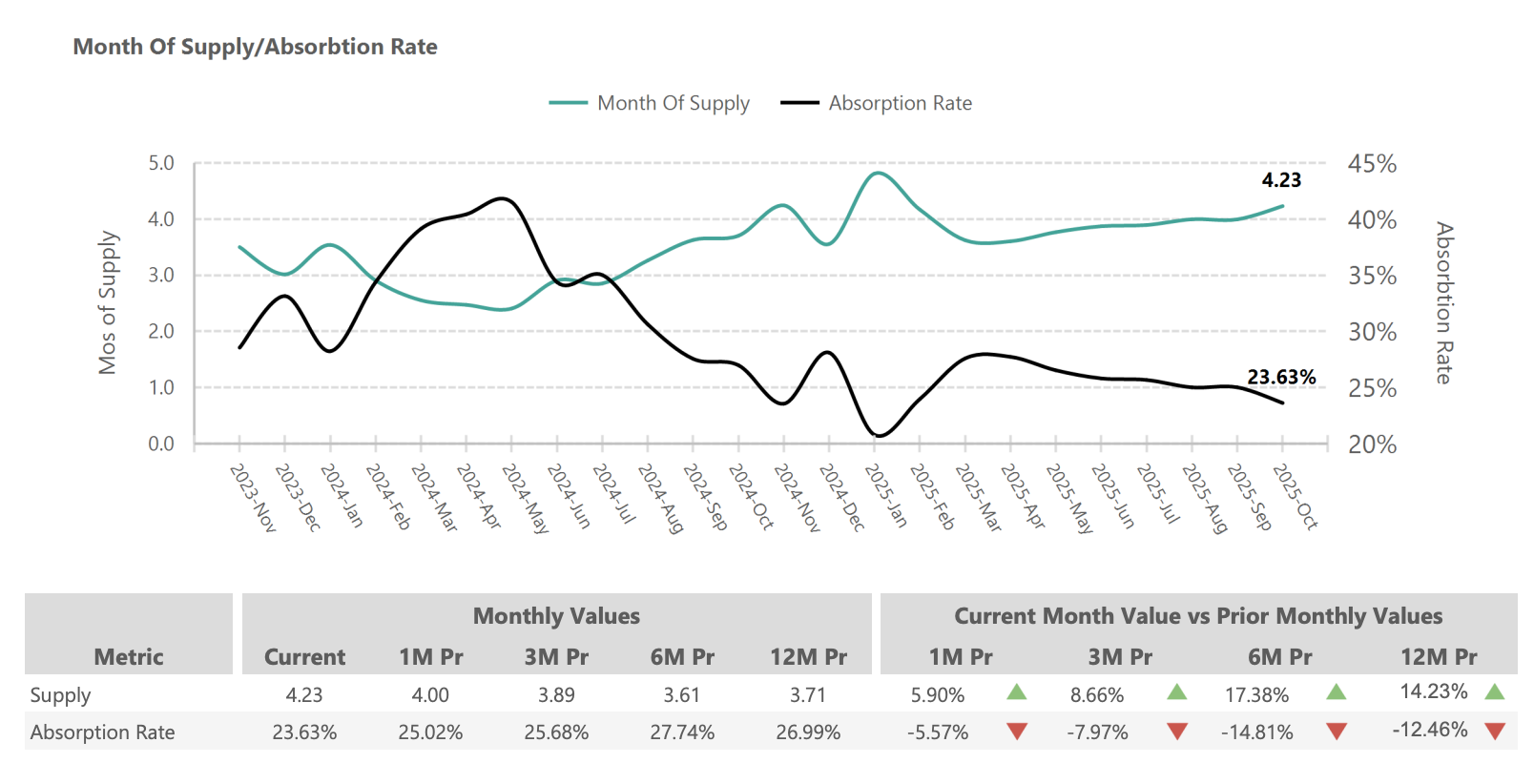

Market supply: 4.23 months (+14.2% year-over-year) – months of supply is just over four months, inching closer to a balanced 5–6 month level as listings stay on the market longer.

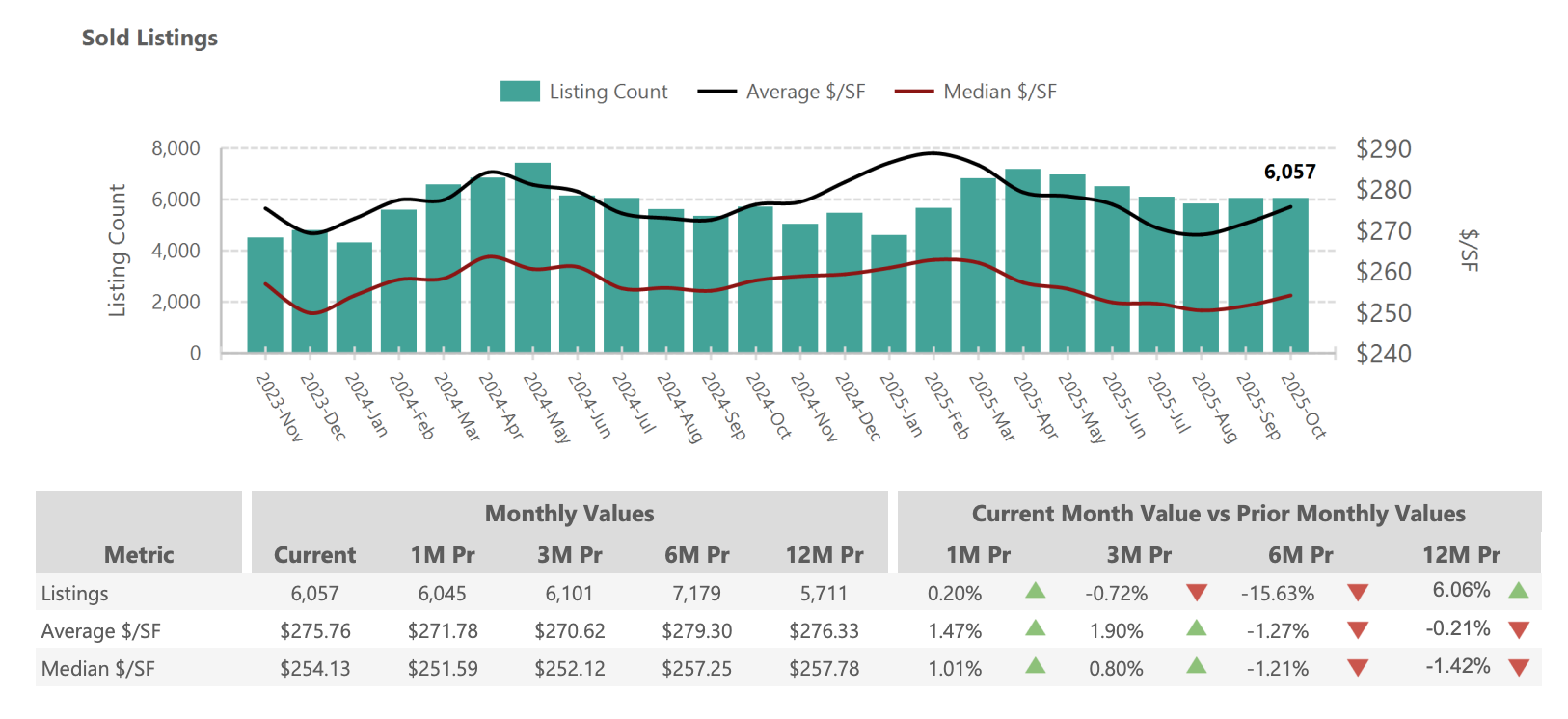

Sales volume: 6,064 homes sold (+4.9% from Oct 2024) – slightly more sales closed than a year ago, a sign of steady demand even amid higher interest rates and abundant supply.

Phoenix’s housing market in October 2025 demonstrates a healthy balance that has emerged over the past year. Buyers benefit from the widest selection of homes in over a decade and more time to make decisions, while sellers who price competitively can still achieve successful outcomes thanks to consistent buyer demand. Mortgage rates hovering in the mid-7% range have tempered some purchasing power, but the area’s strong economy and population growth continue to support housing activity. Overall, Greater Phoenix real estate as of late 2025 offers a calmer, more predictable environment: neither a runaway seller’s market nor a buyer’s market downturn, but a stable middle ground where informed strategy and realistic expectations are key for both sides.

Phoenix Home Prices October 2025: Steady and Resilient

1- Current Pricing Trends

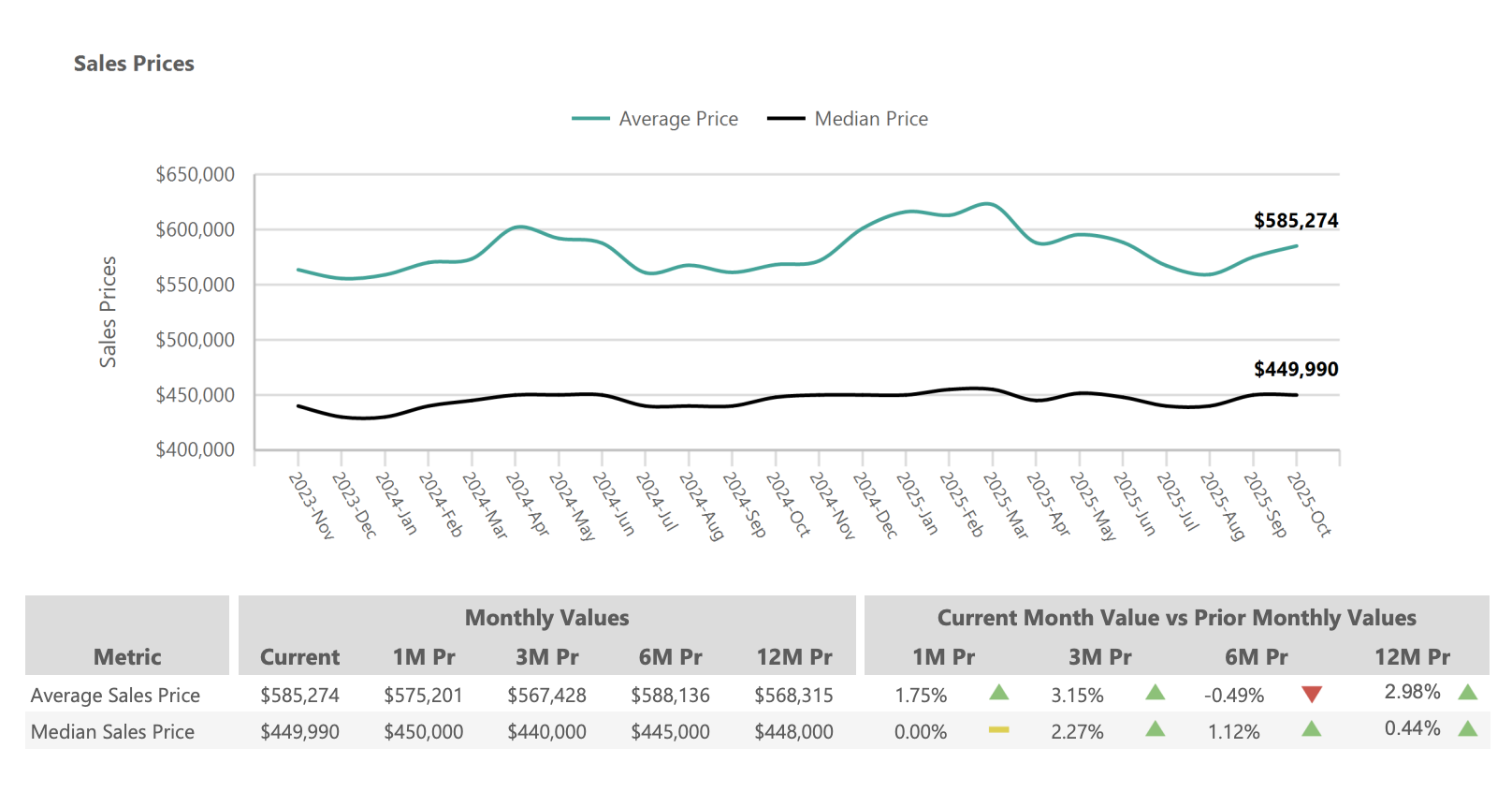

Phoenix home prices held firm in October 2025, with the median sales price at approximately $450,000, essentially flat (+0.4%) compared to October 2024. This lack of significant change year-over-year signals that the market has found a sustainable price plateau following the rapid run-up and slight decline of recent years. The average sales price similarly stood around $585,000 in October, up about 3% from the same time last year. Month-to-month movement was minimal – October’s median matched September’s $450K, indicating stability through the fall season. Notably, no price erosion has occurred despite the much higher inventory now on the market. Buyers are no longer forced into bidding wars, yet prices haven’t crumbled; instead, they’re buoyed by steady demand and a strong local economy. In short, Phoenix home values in late 2025 are holding their ground, reflecting a market in equilibrium.

Price Metrics:

Median Sales Price: $449,990 (≈$450K, +0.4% YoY)

Average Sales Price: $585,274 (+2.98% YoY)

Price per Square Foot (Sold Homes): ~$296 (-1% YoY) – average sold price per sqft, virtually unchanged from ~$299 a year ago, indicating stable values.

Price per Square Foot (Active Listings): ~$300 (-2% YoY) – average asking price per sqft for active listings, slightly lower than last October as sellers price realistically in a competitive market.

2- Historical Context

The current median price of ~$450K remains about 6% below Phoenix’s all-time high of roughly $480K reached in May 2022. This modest dip from the peak represents a soft landing rather than a crash, especially compared to past downturns. During the 2008–2011 housing crisis, Phoenix home values plummeted over 50%. In contrast, the recent correction has been mild – essentially a leveling off after the meteoric 20–30% annual gains of 2021. Higher mortgage rates since 2022 have certainly put a cap on how much buyers can pay, but they have not caused a free-fall in prices. Instead, what we’ve seen through 2024 and 2025 is a controlled flattening of the price curve. By late 2024, prices stopped declining and even ticked up slightly in some months. Now in October 2025, with a second consecutive month of year-over-year price stability (slight appreciation in September, then holding steady in October), it’s clear the market has established a new normal. Both buyers and sellers have adjusted to the reality of 7%+ interest rates. Phoenix’s strong fundamentals – job growth, population influx, and a persistent housing shortage relative to long-term demand – have put a floor under prices. The frenzy is gone, but Phoenix home values are resilient, supported by the region’s economic vitality even in a higher-rate environment.

3- Local Variations

Price trends do vary by location and segment. Higher-priced submarkets and luxury homes have seen a bit more of a boost recently, as evidenced by average prices rising a few percent – this is partly due to an uptick in luxury sales lifting the average. In sought-after areas like Scottsdale and North Phoenix, where amenities and schools command premiums, prices are up slightly year-over-year. For instance, Scottsdale’s median jumped a few percent this year, and some affluent neighborhoods saw renewed multiple-offer situations on well-priced homes. By contrast, in some outlying suburbs or entry-level segments, prices have been essentially flat or even down a touch compared to last fall, as those areas felt more of the affordability pinch from higher interest rates. The median price being flat overall suggests that any gains in upscale areas are balancing out minor declines in others. It’s a reminder that real estate is hyper-local; Phoenix’s aggregate stability encompasses micro-markets that may be experiencing subtle shifts. Buyers looking in affordable pockets (for example, the West Valley starter-home communities) might find a tad more negotiating room on price than a year ago, whereas buyers in luxury enclaves might discover competition heating up again for the most desirable properties. Nonetheless, across the Valley the overarching theme is consistency – dramatic price swings have given way to a patchwork of modest ups and downs, the hallmark of a normalized market.

Phoenix Housing Inventory Surge: 25K+ Homes for Sale

1- Record Inventory Growth

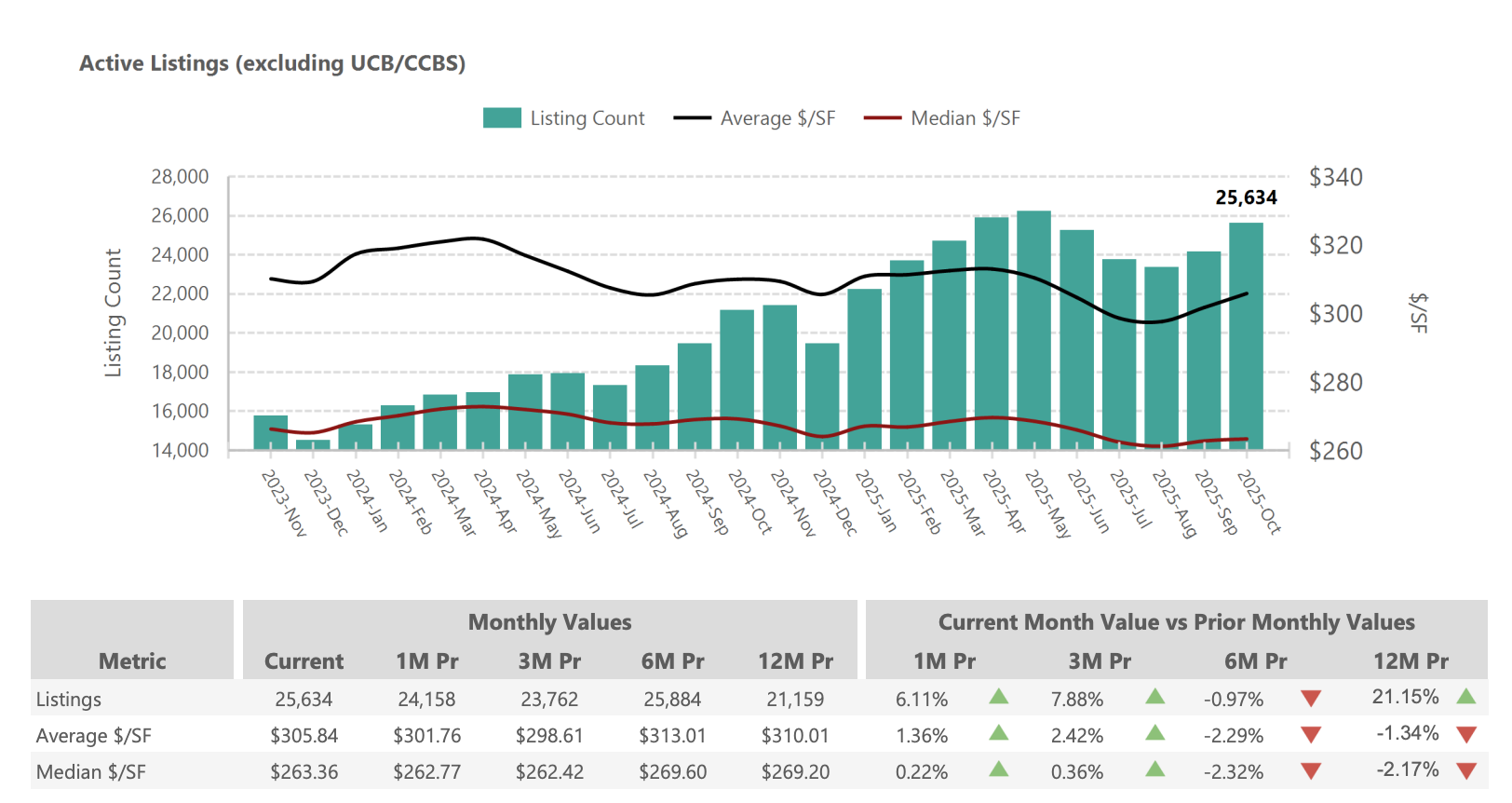

One of the most striking developments of the past year has been the surge in active inventory. In October 2025, there are roughly 25,500 homes for sale across Greater Phoenix – about a 5% increase from the already elevated inventory of October 2024, and a dramatically higher supply than two or three years ago. Buyers now have more options than at any time in recent memory, fundamentally altering the market dynamic from the ultra-competitive, low-inventory environment of the pandemic boom. This inventory expansion was fueled by several converging trends: more homeowners listing their properties (new listings rose about 8–10% in 2025 compared to 2024), a return of sellers who had postponed plans (some locked-in to low rates, now finally moving due to life changes), and a wave of new construction completions adding fresh supply. The result is that Phoenix buyers can afford to be selective in a way that was impossible when choices were scant. This abundance of listings has psychological impacts too – buyers feel less pressure to “grab whatever they can find” and are more inclined to take their time. Sellers, on the other hand, face the reality that competition is stiff; each listing must shine on price, condition, or unique features to attract offers now. Overall, the inventory surge represents a fundamental shift toward a balanced market, definitively ending the scarcity-driven bidding wars of the 2021-2022 period.

Inventory Metrics:

Active Listings: ~25,500 homes for sale (+5% YoY) – inventory is on par with last fall’s elevated level, marking a plateau after 2024’s large gains.

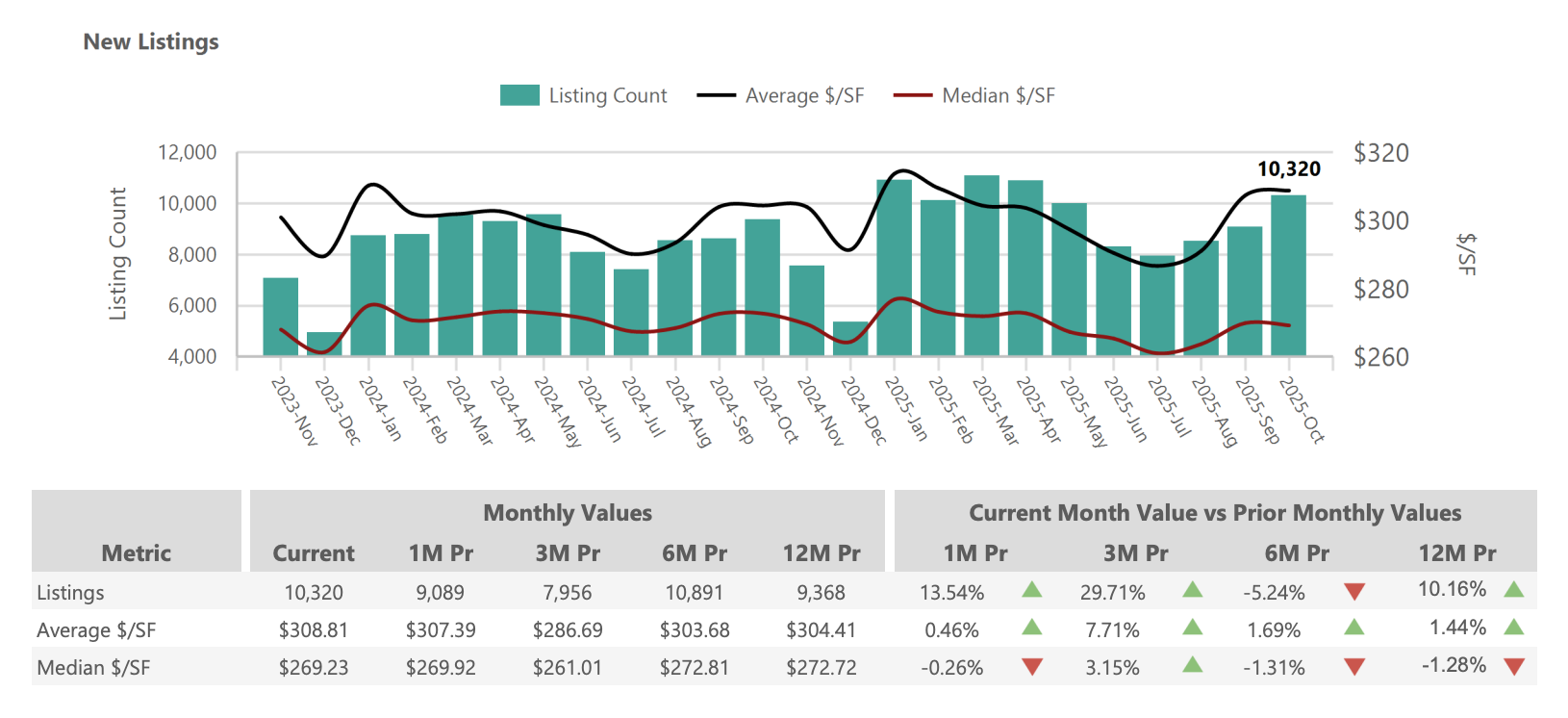

New Listings (Added in Oct): 9,500 (approximately +9–10% YoY) – new supply coming to market outpaced October 2024, as more sellers listed homes this fall than last.

Months of Supply: 4.23 months (+14.2% YoY) – about four months’ supply, up from 3.7 months a year ago, reflecting easier conditions for buyers as homes take longer to sell.

Absorption Rate: 23.6% (-12% YoY) – roughly 24% of active listings sold in the month, down from ~27% last October, meaning a smaller portion of inventory is clearing each month.

2- Seasonal Patterns and Trends

Phoenix’s inventory typically peaks in late spring each year, and 2025 was no exception. Active listings reached over 26,000 in May 2025 during the spring selling season. Through the summer, listing counts dipped slightly – by September they had eased to about 24,500 as some spring listings sold or were withdrawn during the slow summer months. This seasonal dip is normal; Arizona’s extreme heat in July/August often discourages both sellers and buyers, leading to fewer listings and sales in mid-summer. By October, however, activity picks up again, and indeed we saw active inventory tick back up above 25k as the fall market got underway. Even with these typical seasonal fluctuations, inventory in late 2025 remains far above where it stood at this time in recent years. In October 2024, active listings were about 24k; in October 2023, they were closer to 20k – a testament to how much the supply picture has changed. The fact that 2025’s inventory stayed high even through the summer slowdown suggests structural changes in the market. Many sellers are keeping their homes on the market longer instead of pulling them off unsold, showing confidence that the right buyer will come along eventually. Home builders, too, have continued to finish projects and list new homes, adding supply even in slower months.

Another trend: new listings in October 2025 outpaced last year’s volume (approximately 9,500 vs 8,700 in Oct 2024) – evidence that more homeowners are willing to sell now than a year ago, perhaps because prices have stabilized and they feel they can achieve acceptable values. The increase in new listings, combined with slower sales absorption, has kept inventory elevated. The overall result is that choice abounds for buyers in late 2025. Unlike in past years when a seasonal dip in listings could mean slim pickings by Thanksgiving, this year there is a resilient pool of homes for sale heading into the holidays. This persistent listing availability suggests Phoenix’s market may be undergoing a lasting shift out of the ultra-tight conditions of 2020-2022. Factors like increased construction, higher rates (discouraging frantic buying), and the memory of the pandemic frenzy have all contributed to a calmer, more supplied market. Buyers can be thankful for the breathing room, while sellers must adjust to a landscape where patience and proactive marketing are required.

3- Supply and Demand Balance

With just over 4 months of supply in October, Phoenix’s housing market is hovering near the upper end of a balanced range. This is a dramatic change from the sub-2 month supply during the peak seller’s market of 2021, when inventory was so scant that homes would often get multiple offers within days. At a 4+ month supply, Phoenix is now tilted toward equilibrium – buyers have enough choices that they aren’t pressured to snap up the first house they see, yet inventory isn’t so high as to create a true buyer’s market (which would be 7+ months of supply with widespread price cuts). Many real estate economists consider roughly 4–6 months of supply ideal for healthy market function: it gives buyers time for due diligence and comparison shopping, while still ensuring that most reasonably priced homes will sell within a few months. Phoenix’s trend toward this balanced range suggests the market has achieved a sustainable footing. Minor economic fluctuations – say a quarter-point interest rate move or seasonal slowdowns – are less likely to cause wild swings in prices or sales when supply and demand are in better alignment. In short, the frantic extremes have eased, and a more normal cycle is emerging. Sellers can no longer expect instant bidding wars, and buyers can’t expect fire-sale prices – instead, both parties meet in the middle, often after a period of negotiation.

The increased supply and tempered demand create advantages for buyers that haven’t been seen in some time. With more inventory available, buyers can compare multiple properties without feeling rushed or fearful of losing out. It’s now common for a buyer to tour a dozen homes over a few weeks and then decide, whereas two years ago a buyer might have been lucky to even see a couple of homes before they went under contract to someone else. This breathing room means buyers can insist on inspections, contingencies, and even concessions, which many waived during the frenzy. Indeed, we’re seeing more offers where buyers request seller concessions (for example, asking the seller to cover closing costs or provide a mortgage rate buydown). Sellers, for their part, are often amenable to such concessions if their home has been on the market for a while – a big change from 2021, when sellers could simply pick the highest, cleanest offer in 48 hours. The negotiating playing field is far more even in today’s market. From the seller’s perspective, reaching a deal may take longer, but the transactions that do happen are more likely to “stick”: buyers, having had time to vet the home and feel comfortable with their decision, are less prone to backing out due to cold feet or discovery of minor issues. Most well-priced, well-presented homes are still selling in this market, just not overnight. In fact, the listings that tend to attract quick interest now are those that check all the boxes – priced competitively and move-in ready in desirable locations. Such homes can still see multiple offers or go under contract within a couple of weeks, as savvy buyers recognize their value. However, the days of across-the-board bidding wars are essentially over. Instead, Phoenix real estate in late 2025 is characterized by orderly negotiations and more balanced terms, which ultimately benefit both sides by reducing stress and fostering fair outcomes.

Days on Market: Homes Taking Longer to Sell

1- Extended Selling Times

Homes in Phoenix are taking significantly longer to sell in October 2025 compared to a year ago. The median days on market (DOM) reached 62 days, up from 52 days in October 2024 – a ~19% increase in marketing timearmls.com. Similarly, the average DOM is around 87 days (nearly three months), about two weeks longer than a year ago on average. These extended timelines mark a fundamental shift in market tempo: buyers no longer feel the need to rush to make an offer within 24–48 hours. Instead, many homes now sit on the market for several weeks before finding a buyer. It’s important to note that properly priced homes – those listed at a fair market value relative to their condition and location – can still attract offers within the first 2–4 weeks. However, overpriced listings often languish for 60+ days with little buyer interest, usually prompting price reductions to spark activity. We’re seeing the biggest jumps in DOM for higher-priced and less-updated properties, where buyers are being especially choosy. Entry-level homes, in contrast, continue to see relatively strong demand and may sell faster (since there are always many first-time buyers), though even that segment isn’t immune to the overall slowdown. This trend of longer selling times underscores the shift to a buyer’s market mentality – patience has returned to the market. Buyers don’t feel urgency or FOMO (“fear of missing out”) like they did during the pandemic frenzy, and sellers must recalibrate expectations away from the lightning-fast sales of the recent past.

Days on Market Data:

Median DOM: 62 days (was 52 days in Oct 2024, +19% YoY)

Average DOM: 87 days (was ~73 days in Oct 2024, +19% YoY)

Month-over-month: Little change – October’s median DOM was about the same as September’s (just a 1-day improvement from 63 in Sept to 62 in Oct). The selling pace stabilized in fall after lengthening over the summer.

2- Market Psychology Shift

The lengthening of DOM reflects a major shift in psychology for both buyers and sellers. Buyers are no longer worrying that if they “hesitate today, the house will be gone tomorrow.” Back in 2021-2022, many buyers felt compelled to make an offer within hours of a listing hitting the market, often foregoing inspections or other safeguards. Now, with abundant inventory, buyers can take their time – they might view a property multiple times on different days, compare it with several other options, and even wait to see if the seller drops the price after a few weeks. This relaxation of urgency has eased a lot of the anxiety and stress on the buy side. Sellers, on the other hand, have had to adjust their expectations dramatically. Instead of assuming that a weekend on the market will yield a frenzy of offers, sellers must accept that it may take 2-3 months (and one or two price reductions) to secure a buyer. This means budgeting for extra mortgage payments and keeping the home in show-ready condition for longer. Pricing strategy has become crucial – homes priced right (in line with recent comparable sales) are the ones still getting quick interest. If a home is overpriced relative to its condition or location, today’s buyers will simply pass it by, leading to extended DOM and likely a price cut down the line.

Interestingly, the slower pace of sales is leading to better outcomes in many cases. Buyers who move forward with a home purchase have thoroughly vetted the property and are confident in their decision, reducing the chances of buyer’s remorse or contract fallout. Sellers, meanwhile, are dealing with buyers who are more committed (having had the time to be sure of their choice and secure solid financing). The negotiation dynamic has also evolved – with more time on market, buyers feel emboldened to ask for repairs or credits, and sellers are more willing to concede, whereas in a frenzy market buyers would often waive contingencies and take homes “as is.” All these changes point to a market driven less by emotion and panic, and more by rational decision-making. In the long run, that’s a healthier place to be. Transactions are proceeding at a more measured, orderly pace, which means fewer surprises after contract and a greater likelihood of closing once a deal is inked.

Properties that are priced correctly for current market conditions typically still receive offers within a few weeks. Well-presented homes (professionally staged, photographed, and marketed) can stand out and sell faster than the average, even garnering multiple offers if they hit the sweet spot of value. However, overpriced listings can sit for 2+ months with little activity. We’re seeing many such listings eventually require a mid-course correction – after 30-60 days with no sale, sellers are cutting the price by 3-5% or offering incentives like paying the buyer’s closing costs to spark interest. In short, sellers can no longer bank on rapid appreciation or desperate buyers; they must meet the market where it is today. The upside is that once a home is adjusted to the right price, there are indeed buyers out there, and those buyers are serious. The homes that sell now are typically those that present the best value in their bracket – and fortunately, in this balanced environment, both parties tend to walk away feeling the deal was fair.

3- Strategic Implications

For sellers, the longer DOM environment emphasizes the importance of:

Accurate initial pricing: Study recent comparable sales and list your home at a realistic price from the start. The first 2–3 weeks on market are critical – you don’t want to squander that window with an inflated price that scares off buyers.

Impeccable presentation: With ample competition, making your home shine is key. This means decluttering, deep cleaning, staging furniture to maximize space, and investing in professional photography. Online appeal has never been more important now that buyers have many listings to scroll through.

Patience and flexibility: Be prepared mentally and financially for a 60-90 day sale timeline. Build in contingency plans for carrying costs if your home doesn’t sell as fast as hoped. And be ready to adjust – whether that’s a price reduction after a month with no offers, or negotiating repairs and concessions once you have an interested buyer. In this market, rigidity can cost you a deal.

Buyers, meanwhile, should take advantage of the breathing room but remain decisive when they find a home that truly fits their needs. Tips for buyers now include:

Shop around and compare: You likely have the luxury to see a dozen or more homes. Use this to your advantage to learn the market. When inventory was tight, compromise was necessary; now you may be able to get more of your wish list. Don’t rush, but do stay actively engaged so you recognize a great value when one appears.

Maintain financial readiness: Even though you have more time, it’s still important to have your pre-approval and finances in order. When you do decide to make an offer, a strong financing package and a reasonable offer (perhaps slightly under asking if the home has sat a while) can often be negotiated to a win-win.

Think long-term: With prices stable and inventory high, this is an excellent environment to carefully choose a home you’ll be happy in for years. Make sure the home and the monthly payment (at current interest rates) are comfortable for your budget. There’s less expectation of rapid appreciation to bail out a risky purchase, so focus on what makes sense for you in the long run. If rates fall in the future, that will be a bonus (you can refinance), but choose a home that you can afford with today’s financing.

For both buyers and sellers, working with an experienced real estate agent who understands these market nuances is invaluable. In a balanced market, skilled negotiation, pricing strategy, and marketing can make a bigger difference than in a red-hot market where everything sells. The bottom line: Phoenix’s housing market has entered a new phase where strategy, preparation, and patience win the day over pure speed.

Actionable Advice for Market Participants

For the first time in years, Arizona’s largest MLS (ARMLS) data confirms that Phoenix has entered a truly balanced market. Housing inventory is elevated (over 25,000 active listings), the median sale price is holding steady around $450,000, and homes are taking longer to sell (median 62 days on market) – all signs of a leveling playing field. A balanced market (typically 4–6 months of supply, Phoenix is ~4.2 months now) means neither buyers nor sellers have a dominating advantage. In this environment, all parties need to adjust their strategies. Below are practical, data-backed recommendations for buyers, sellers, and investors in the Phoenix area.

For Buyers

Opportunities in Current Market

Ample Choices & Negotiation Power: With active listings now above 25,000, buyers have a much broader selection of homes than in recent years. This elevated inventory means less competition per house and more time to compare options. Homes are spending a median of about 62 days on the market (significantly longer than last year), indicating sellers aren’t receiving offers as quickly. As a result, buyers can negotiate more assertively on homes that have lingered – for example, offering below asking price or requesting seller-paid closing costs on a listing that’s been active for a month or more. An increasing Days on Market (DOM) is essentially a signal of softening demand, which savvy buyers can use as leverage in negotiations.

Stable Prices Reduce Urgency: Phoenix’s median sale price is holding around $450,000, virtually flat month-to-month. Unlike the frenzy of 2021-2022, prices aren’t running away from buyers – which reduces the pressure to “buy now or miss out.” You can take time to thoroughly inspect properties and include contingencies (appraisal, inspection, etc.) without fear of prices surging overnight. However, don’t expect huge bargains either; steady prices mean well-maintained homes that are priced right are still selling close to market value. The good news is that with more inventory and longer market times, you’re more likely to secure small concessions that were rare a couple years ago – such as sellers covering repair costs, offering a home warranty, or contributing to a mortgage rate buydown. In short, the balanced market gives Phoenix buyers breathing room to make informed decisions and negotiate a fair deal.

Strategic Recommendations

Get Your Financing Ready: Even though the market has cooled, desirable homes can still go quickly. Strengthen your position by getting pre-approved for a mortgage before you start home shopping. A pre-approval not only clarifies your budget but also signals to sellers that you’re a serious, qualified buyer. This way, if a well-priced, move-in-ready home comes up in an area like Arcadia or Gilbert, you can move decisively. Being financially prepared lets you jump on a good deal, while other buyers are still arranging their financing. In a balanced market you may have more time, but the best properties – those “cream of the crop” homes – will attract interest and you’ll want to be ready to act.

Target Motivated Sellers: Prioritize listings with 30+ days on market or those that have had price reductions. These sellers may be more flexible on price and terms. Today’s absorption rate is about 23.6%, meaning only roughly one in four listings sells in a given month – a clear sign that many sellers are not finding buyers immediately. If a home has sat for several weeks, that’s your cue to consider making an offer below the asking price or to request seller concessions (e.g. asking the seller to pay part of your closing costs or buy down your interest rate). For instance, if a property listed at $480K has seen no offers in six weeks, you might offer $465K and ask for a few thousand toward closing fees. Sellers are more likely to engage rather than risk waiting another month. Leverage your real estate agent’s local knowledge as well: they can identify which listings are overpriced “stickers” versus hidden gems that just need the right offer.

Be Patient but Alert: Enjoy the breathing room a balanced market provides – you no longer need to rush into an offer after a 15-minute showing. Take the time to compare similar homes, explore different neighborhoods around Phoenix, and ensure you’re making the right choice. That said, don’t become complacent. Well-priced homes in prime locations (e.g. a updated house in Chandler or a turnkey property in North Phoenix) can still draw multiple offers. If a home checks all your boxes and is priced fairly, be ready to submit a strong offer promptly. Use your leverage wisely: rather than throwing out a very lowball offer on Day 1 (which might alienate the seller), make a reasonable offer with supporting comps and perhaps some contingencies. The goal is a win-win deal. Remember that mortgage rates are still on the higher side historically – if you need help with affordability, consider negotiating a rate buydown or closing cost credit into your deal instead of just a lower sticker price. In summary, balance patience with preparedness: the Phoenix market now rewards buyers who do their homework and strike when value appears

For Sellers

Current Market Realities

More Competition, More Selective Buyers: Phoenix’s housing supply has swelled to roughly 4.2 months, squarely in balanced-market territory. With 25,000+ active listings on the market, buyers have plenty of options. This means an overpriced or poorly presented home is likely to be passed over. Properties are taking longer to sell on average – the median Days on Market is now about 62 days, up dramatically from ~51 days this time last year. In practical terms, this isn’t 2021 anymore; you probably won’t have 10 offers in the first weekend. Expect that it could take several weeks or a few months to find the right buyer. During that time, you’ll be competing with other sellers, so setting realistic expectations is crucial. If three similar homes are for sale in your neighborhood, today’s buyers will carefully compare price, condition, and upgrades. They’ll skip homes that don’t stack up. Understanding this mindset will help you avoid frustration if your home doesn’t sell immediately.

Balanced Market Dynamics: In a balanced market, negotiating power is more evenly split. Don’t be surprised if buyers write offers below your list price or include requests that were rare a couple of years ago (repair credits, paying for closing costs, etc.). At the current absorption rate (~24%), only about a quarter of listings sell each month, so buyers know many homes aren’t moving quickly and they feel empowered to ask for more. The flip side is that prices in Phoenix are not plummeting – in fact, the median sale price is slightly up year-over-year and holding around $450K. Serious buyers are indeed in the market and willing to pay fair value for the right home. What’s changed is their attitude: if your pricing or presentation is off, they’ll move on, because they have choices. Sellers must recognize that today’s buyers are more discerning. You may get fewer showings, and feedback might often be that buyers felt the home was “priced too high” or “needed updates for the price.” This is normal now. It’s a rebalancing, not a crash – think of it as the market returning to a healthy equilibrium after the overheated peak. Adjusting to this reality will help you stay patient and proactive.

Success Strategies

Price Competitively from the Start: In this market, the right price is key. Gone are the days when you could price 10% above market and still spark a bidding war – unless your home is truly exceptional, that strategy will backfire today. Instead, work with your agent to examine recent comparable sales (the last 3–6 months in your area) and list at a price that reflects current value. Often, pricing slightly below the nearest competition can attract attention and lead to a faster sale (and sometimes even a full-price offer). Remember, if you start too high and sit on the market, you may end up chasing the market down with price cuts. It’s better to be realistic and competitive on day one. A good rule of thumb: if similar homes are selling at $500K, pricing yours around $495K (assuming similar condition) might entice more buyers to see it as a deal, whereas pricing at $525K will likely deter them. The data shows homes are generally selling at around 98% of list price on average now (rather than over 100% in the frenzy), so avoid the trap of overpricing and expecting an over-ask offer. A well-priced home not only sells faster, it often nets you more in the end than a stagnant, overpriced listing that requires multiple reductions.

Maximize Your Home’s Appeal: With buyers being more choosy, presentation matters. Before listing, take time to prepare your home: declutter, deep clean, and address any obvious repairs. Consider professional staging if the home is vacant or outdated – a nicely staged home can help buyers emotionally connect and visualize living there. Invest in high-quality photography and marketing, as most Phoenix buyers will encounter your property online first. In a balanced market, the listings that stand out for their condition and features will get the quickest offers. Sellers who are succeeding now are “leveraging staging, pro photography, and market-aligned pricing” to draw in buyers. Highlight in your listing remarks anything that sets your home apart: energy-efficient upgrades, a new HVAC, a remodeled kitchen, a great backyard, or proximity to desirable amenities. These selling points can tip a buyer’s decision in your favor, especially if they’re comparing multiple options. Ultimately, make your property the obvious best choice among the competition by combining the right price with an appealing, move-in-ready presentation.

Offer Incentives & Stay Flexible: In a cooler market, a bit of seller flexibility can go a long way to secure a deal. Be open to creative concessions if they’ll get the deal done. For example, you might offer to pay for a home warranty or agree to cover a portion of the buyer’s closing costs – this can attract budget-conscious buyers without requiring a large price cut. Another smart tactic is offering a mortgage rate buydown: using some of your proceeds to lower the buyer’s interest rate for the first couple of years. This can make your home more affordable to a wider pool of buyers, effectively “sweetening the deal.” Also, prepare for the possibility of contingent offers. With many buyers also needing to sell their current home, you might receive an offer that’s contingent on the buyer’s home selling. While such offers were rare in 2021, they’re increasingly common in 2025’s balanced market. Examine these case by case – if the buyer’s home is already under contract or in a strong market, a contingent offer could be solid. Being too rigid (for instance, refusing to entertain anything but non-contingent, full-price offers) could mean missing out on a qualified buyer. Additionally, once under contract, expect that the buyer may negotiate on repairs after the inspection. It’s wise to take care of known issues upfront if possible (e.g., fix that leaky faucet or faulty water heater before listing), but if a reasonable repair request comes through, work with the buyer to find a solution. By remaining flexible and responsive, you increase your chances of a successful closing. Remember, the goal is to meet in the middle – balanced market negotiations often involve a bit of compromise on both sides.

For Investors

Market Opportunities

More Inventory = Better Deals: The surge in listings means more potential deals for investors. In the peak seller’s market, finding a profitable flip or a cash-flowing rental was challenging because every property had multiple offers. Now, with inventory at multi-year highs, you can afford to be selective. There’s a higher chance of finding properties with motivated sellers – for instance, an older home in Peoria that needs work and has sat unsold for 60+ days might be acquired below asking price. Notably, some large institutional buyers (Wall Street-backed funds, iBuyers, etc.) have pulled back in 2025, which creates more room for individual investors to maneuver. Fewer big players bidding means you’re less likely to be outbid by an all-cash corporate offer, and you may secure properties at more favorable terms and pricing. Use this period to your advantage: hunt for listings that meet your investment criteria (whether it’s a certain neighborhood, lot size, or price point) and watch for price drops. It’s a numbers game – with more inventory, the probability of finding an undervalued gem increases.

Steady Prices & Solid Rental Demand: A balanced market in Phoenix also signals that home values are leveling off, which can actually be positive for investors. You’re not buying at an extreme peak, and you can underwrite deals with more confidence that comps will remain in a similar range in the short term. The median price of ~$450K has been stable, and annual appreciation is modest (~2% YoY), suggesting we’re in a period of price plateau. Meanwhile, rental demand remains strong across the Valley, buoyed by Phoenix’s continued job and population growth. The city’s expanding tech, healthcare, and manufacturing sectors are bringing in new residents, and many of them will rent before they buy. Occupancy rates for rentals are healthy, and rents are holding firm or even rising slowly. For a buy-and-hold investor, this means you can purchase a property now without chasing rising prices, lock in your costs, and collect stable rent while the market gradually appreciates. The balanced conditions “reward investors who act decisively” to acquire quality assets and hold for steady returns. For example, if you invest in a duplex in Central Phoenix today, you can likely rent out both units quickly given current demand, and enjoy consistent cash flow. Over the next few years, as Phoenix continues to grow, you could see both your rents and property value creep upward at a sustainable pace.

Niche Plays and Timing: In a cooler market, certain niches become attractive. Luxury and high-end homes are sitting longer now, which can present an opportunity to buy at a discount in upscale areas. An investor with the capital to purchase a higher-end property (say in Scottsdale or Paradise Valley) might negotiate a great price, then rent it out or Airbnb it until the market picks up again. Similarly, new construction homes: builders with unsold inventory toward year-end might offer significant incentives – from price cuts to free upgrades or rate buydowns – which could benefit investors who are open to buying new homes as rentals. Keep an eye on segments like condos or townhomes near downtown and college areas, which might be slower to move this season; these could be scooped up and turned into profitable rentals when student and young professional demand bounces back. Short-term rental (STR) markets have also normalized, so you might find a vacation rental-friendly condo at a reasonable price now, whereas a couple years ago those were snapped up instantly. Always do your homework on local regulations (some Phoenix-area cities have STR restrictions), but know that a balanced market gives you the luxury of exploring these strategies. You can negotiate favorable deals in areas or property types that were previously untouchable due to investor competition.

Risk Management

Account for Higher Financing Costs: One thing that hasn’t reverted to 2019 levels is interest rates. As an investor, the cost of borrowing is a critical part of your math. Rates in late 2025 are higher than the ultra-low levels we saw earlier in the decade, so plan your purchases with a conservative eye on financing. If you’re using a mortgage or hard money loan, build in a buffer for those interest payments. For buy-and-hold investments, consider using fixed-rate loans to lock in your expenses – this protects you if rates rise further. Alternatively, if you use an adjustable or interest-only loan to maximize cash flow, have a strategy for when that rate adjusts. A savvy move in this balanced market is to negotiate a seller concession that can buy down your interest rate for the first couple of years. For example, if a seller won’t budge much on price, see if they’ll contribute, say, 2% of the price towards your closing costs – you can use that to prepay points and reduce your rate by maybe half a percent. This improves your immediate cash flow and gives you breathing room in case rents temporarily soften or if it takes longer to find a tenant. Always stress-test your deal: assume a slightly lower rent or an extra month of vacancy and ensure you can still cover your mortgage. By being cautious and locking in favorable financing, you’ll mitigate risk and avoid negative cash flow surprises.

Plan for Longer Sell Times (Flippers, Take Note): If your strategy is fixing and flipping homes, be prepared for the reality that selling the renovated property might take longer now. In the current market, the average DOM is up, and even nicely rehabbed homes won’t necessarily fly off the shelf in a week. When you acquire a flip, budget for at least 2-3 months of holding costs after the rehab is complete, to account for marketing time. This includes mortgage payments, property insurance, HOA fees (if any), and maintenance. Price your flipped home realistically to move it – overpricing a flip in a balanced market can lead to it languishing unsold, eating into your profit. It’s wise to have a Plan B in case the sale takes longer than expected: for instance, could you rent the property for a year and try selling later if the market slows further? Phoenix’s rental market can be an effective safety net; even if you didn’t plan to be a landlord, renting out a flip for a year could cover your costs and possibly let you sell at a better time. The key is to remain flexible. If an offer comes in a bit below your ideal price, weigh the cost of continuing to hold out for more versus the certainty of a sale. In a balanced market, turning over your capital efficiently might be better than holding out for top dollar.

Thorough Due Diligence & Diversification: Finally, managing risk means doing your homework on each investment and not putting all your eggs in one basket. In the frenzy of a hot market, some investors cut corners on inspections or rushed deals to win bidding wars. Now you have the breathing room to fully vet properties – use it. Always get a professional inspection, verify the property’s condition (roof, HVAC, plumbing – major issues can kill your returns), and double-check comparables for both sale and rent values. Understand the neighborhood’s trajectory: is the area growing, flat, or declining? In Phoenix, even in a generally strong market, some sub-markets perform better than others. Focus on locations with enduring appeal – good schools, access to jobs, low crime – these tend to hold value best in any market. Also, consider diversifying your portfolio across different property types or price points. For example, instead of buying two luxury flips at once, you might do one flip and use additional funds to pick up a couple of entry-level single-family rentals. Diversification can protect you – if the high-end flip struggles to sell, your rental properties in a more affordable segment can provide steady income to offset carrying costs. The Phoenix economy remains robust and diverse (from tech companies to new manufacturing plants), which bodes well for real estate long term. But real estate is inherently local and cyclical. By managing leverage cautiously, keeping cash reserves, and spreading out your investments, you’ll be in a better position to weather any surprises that the market might bring. Investors who stick to fundamentals and buy with a margin of safety can thrive even as the market balances out.

Phoenix Housing Market Video Update

Stay tuned for our October 2025 Phoenix Housing Market video update – a quick, visual breakdown of the latest numbers and trends. In just a few minutes, you’ll see charts and expert commentary on price stability, inventory changes, and what they mean for you as a buyer or seller. Our video highlights key stats and provides context on economic factors influencing Phoenix real estate now. Sometimes a visual snapshot makes the market’s status crystal clear – don’t miss it!

Conclusion: A New Normal Takes Hold

The Phoenix housing market in October 2025 represents a healthy recalibration from the extreme conditions of a few years ago. We now see balance emerging where once there was frenzy. Price stability (even modest gains in some areas) combined with greatly expanded inventory has created opportunities for both buyers and sellers – but succeeding in this market requires adapting to the new dynamics.

Key market themes include:

Stability over volatility: The era of whiplash-inducing price swings is behind us. Moderate, steady trends are now the norm, which is positive for market health and long-term planning.

Choice over scarcity: Buyers can finally choose from a range of options instead of fighting over a single listing. This choice leads to more satisfactory outcomes – people buying homes that truly fit their needs rather than just whatever was available.

Strategy over speed: In 2021, speed was everything. Now, strategy wins the day. Thoughtful pricing, savvy marketing, and diligent home search/negotiation have replaced frantic bidding wars. Both sides need to be strategic and informed to achieve the best results.

Balance over extremes: Neither buyers nor sellers have an overwhelming upper hand today. Each side must come to the table and find middle ground. This balance fosters more equitable transactions and a more resilient market overall.

Phoenix’s housing sector appears well-poised as we move toward 2026. We do not anticipate a return to the runaway seller’s market of the pandemic era, nor do we foresee a crash – instead, a continued balanced trajectory is likely. The city’s strong job growth, desirable lifestyle, and ongoing population inflows provide a solid foundation for housing demand. For buyers, this means you can proceed with confidence that you’re not overpaying at an unsustainable peak; you have time and options to make a sound choice. For sellers, it means that if you price and present your home well, it will sell – maybe not overnight, but to a motivated buyer who appreciates it. The current environment rewards those who stay informed and work with seasoned real estate professionals. Whether you’re a first-time homebuyer, a move-up seller, or an investor, understanding the trends and statistics (like those in this report) will help you make the best decisions.

For personalized insights or guidance on navigating this evolving market, reach out to the Phoenix real estate experts at PhoenixHomes.com. Our team is on top of the latest data and ready to help you craft the right strategy – whether that’s timing your sale for maximum return or negotiating a great deal on your next home. The Phoenix housing market has changed, but with the right knowledge and partner by your side, your real estate goals in 2025 and beyond are well within reach.